What is an Opportunity Zone?

An Opportunity Zone is a low-income census tract with an individual poverty rate of at least 20 percent and median family income no greater than 80 percent of the area median.

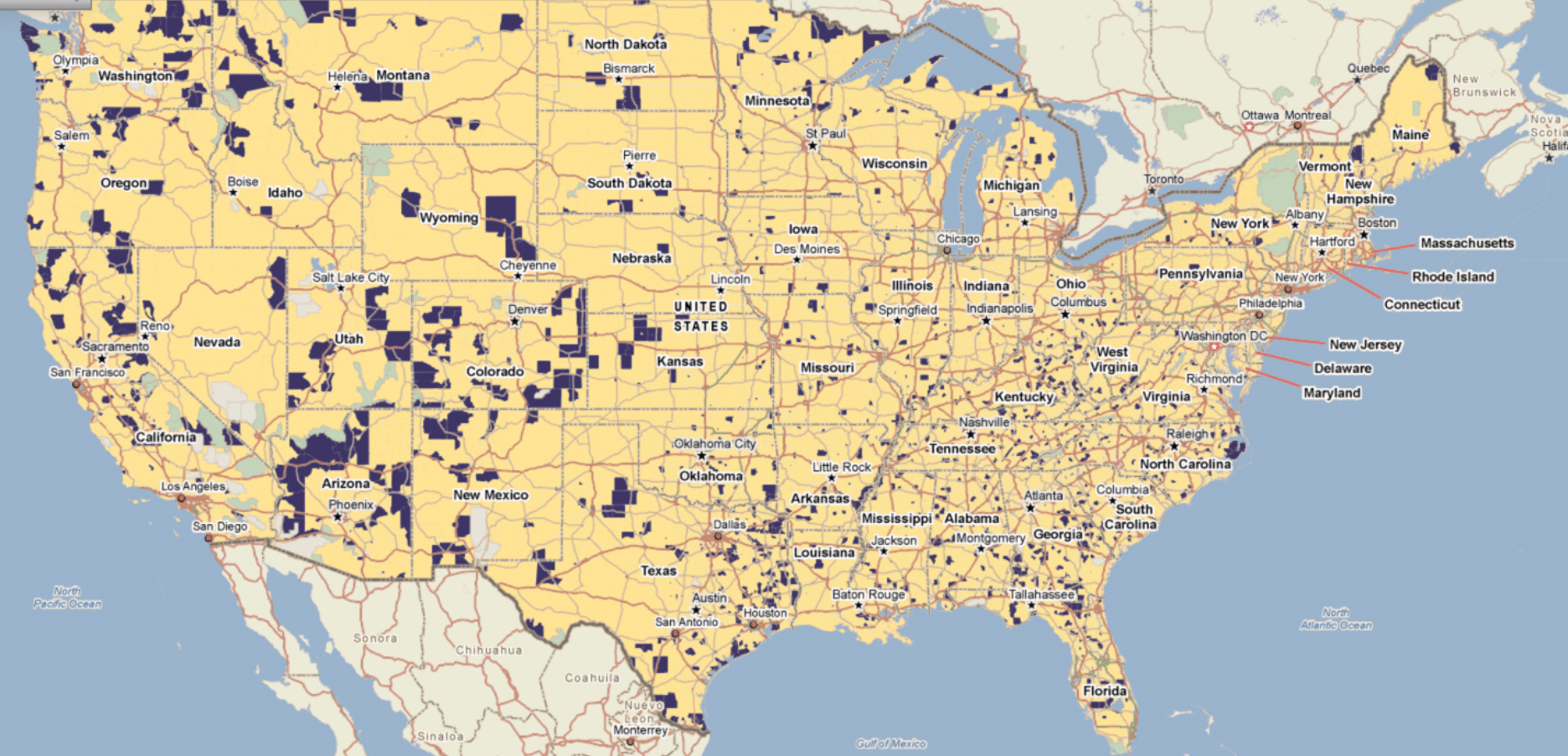

Opportunity Zones are an economic development tool that allows people to invest in distressed areas in the United States. Their purpose is to spur economic growth and job creation in low-income communities while providing tax benefits to investors.

Opportunity Zones were created under the Tax Cuts and Jobs Act of 2017 (Public Law No. 115-97). Thousands of low-income communities in all 50 states, the District of Columbia and five U.S. territories are designated as Qualified Opportunity Zones.

Taxpayers can invest in these zones through Qualified Opportunity Funds.

Source: PolicyMap

How do you qualify to invest in an opportunity zone?

With most OZ funds, you must be an accredited investor— you must have a net worth of $1 million, excluding your primary residence, or have two consecutive years of at least $200,000 in annual income if you’re a single tax filer ($300,000 for married filers).

What are the requirements to create an opportunity zone fund?

The IRS describes an Opportunity Zones fund as an investment vehicle that files either a partnership or corporation federal income tax return and is organized for the purpose of investing in qualified Opportunity Zones property. You can get and file Form 8896, from the IRS and create a qualified opportunity fund.

It can be structured as a partnership or corporation as long as the purpose is to invest in one of the Opportunity Zones’ census tracts, through real estate or in businesses through equity. But remember, the fund must hold the bulk — 90% — of its assets in an Opportunity Zones area.

Anyone can form a QOF and that opened the doors to funds supporting investors looking to shelter capital gains that go into projects. For startup companies and for businesses the amount of capital gains can actually be fairly minimal but there has to be some kind of capital gain that forms the basis of it.

The lion’s share of qualified opportunity funds are going to be LLCs. Now it can be an LLC or a corporation or a partnership, but most will be an LLC that’s taxed as a partnership. So, one of the really important considerations is that when you set up your qualified opportunity fund you must have two members in it. And those need to be distinct members with separate employee identification numbers or taxpayer ID numbers.

In general, an OZ fund must invest at least 90% of its assets in businesses located within a qualified opportunity zone.

How to invest in opportunity zone funds?

Participating in an opportunity zone and the preferential tax treatment they offer is done by placing qualified capital gains in an Opportunity Fund. Opportunity Funds are pooled investment funds that follow specific requirements to gain this designation and there are several opportunity funds to choose between.

Eligible capital gains can be realized from the sale of stocks, bonds, private business, or real estate. Accredited investors can participate in the preferential tax treatment opportunity zones offered by rolling their current capital gains into a qualified OF within 180 days from the sale of the asset in addition to filing IRS form 8949 with their taxes. Non-qualified capital gains funds can also be invested in an OF, but that money will not be eligible for the same tax incentives.

A qualified opportunity zone fund is a private fund structured as a corporation or partnership that invests more than 90% of its capital into an opportunity zone. A recent ruling stated that a fund’s failure to meet the 90% asset test would not disqualify them from being classified as an opportunity fund but may result in a penalty.

Rather than using taxpayer dollars to stimulate economic growth in these communities, the government decided to use private investments. To encourage private participation, individuals who invest in Qualified Opportunities Zones are eligible for tax incentives.

To capitalize on this program, a taxpayer must invest their proceeds from their sale of an asset (realized gain or capital gain) into a Qualified Opportunity Zone Fund. This must happen within 180 days of the sale. However, while a taxpayer may invest the returns of the sale of an asset, as well as the potential gains, the tax incentive only applies to the capital gains.

Also, noteworthy, investors can use the proceeds from any appreciated asset. It’s not a requirement to invest with a like-kind asset to defer potential gains.

What are the tax advantages of an opportunity zone?

The program provides three tax benefits for investing unrealized capital gains in Opportunity Zones:

- Temporary deferral of taxes on previously earned capital gains. Investors can place existing assets with accumulated capital gains into Opportunity Funds. Those existing capital gains are not taxed until the end of 2026 or when the asset is disposed of.

- Basis step-up of previously earned capital gains invested. For capital gains placed in Opportunity Funds for at least 5 years, investors’ basis on the original investment increases by 10 percent. If invested for at least 7 years, investors’ basis on the original investment increases by 15 percent.

- Permanent exclusion of taxable income on new gains. For investments held for at least 10 years, investors pay no taxes on any capital gains produced through their investment in Opportunity Funds.

What are the risks of investing in an opportunity zone?

As with any investment, there are risks with investing in opportunity zones. The largest is the viability of the investment in that zone. Just because there are tax incentives to place money in certain areas, it doesn’t mean every investment will be profitable. The location and type of investment matters. Look for a fund that has diversified assets across different opportunity zones.

Additionally, for investors to take full advantage of the tax incentives offered with opportunity zones, they need to roll a portion of their capital gains into an opportunity fund. This can reduce the diversification of the investor’s portfolio during this period, which can increase exposure to risk.

It’s too early to say what kind of gains, if any, these OZ funds will deliver, or which OZ funds are worthy investments. In fact, the rules on what an OZ fund can invest in and how it should operate are still evolving. That can pose a problem: An OZ fund must comply with a myriad of IRS guidelines. If it doesn’t, it may have to pay a penalty or, worse, the fund’s investors won’t be eligible for the capital gains tax breaks. Understand that distressed real estate deals are inherently risky.You’re buying into an area that people otherwise weren’t willing to invest in.

With little track record, inexperienced managers, high fees and a high hurdle to entry, OZ funds are not right for retirement savings or money you can’t stand to lose or lock up for the required holding periods. They’re geared more for deep-pocketed, savvy investors than mom-and-pop savers. If you’ve never invested in private equity or a closely held investment in which you’re a minority investor, these probably aren’t for you.

What type of assets can you invest in an opportunity zone fund?

The fund can invest in any qualified asset, which may be real property, equipment, or a business where 50% or more of their income is derived from an opportunity zone. Many kinds of businesses qualify under the current guidelines, but a few, including golf courses, massage parlors, casinos and liquor stores, are excluded.

What are the regulations in place to protect investors?

- Let more types of gains qualify for tax breaks. In perhaps the final regulations’ most investor-friendly change, investors in businesses can defer taxes on more types of gains — in particular, gains from the sales of certain business assets like real estate or heavy equipment. Under the tax code’s normal rules, businesses combine their gains and losses from the sales of these assets. Net gains from their sales in a particular year result in capital gains on which businesses pay capital gains taxes, and net losses let businesses take a tax deduction from their ordinary income. That means that businesses typically must wait until the end of the year to determine their overall gain or loss, and the proposed regulations would have followed that approach. Under the final regulations, though, businesses can calculate each sale on its own, giving them the best of both worlds: they can get the opportunity zone tax breaks for each gain, and they can get a full deduction for each loss.

- Let businesses hold cash for longer, making communities wait. To prevent investors from benefiting from opportunity zone tax breaks simply by keeping cash in the bank rather than putting the money into those communities, the law limits the amount of cash that a qualifying business can hold. But the proposed regulations included a generous exception, letting businesses qualify for the tax breaks even if they hold all their assets in cash for up to 31 months. Now, the final regulations expand this exception dramatically — letting some businesses qualify for tax breaks without making any tangible investment in opportunity zones for more than five years.

How long do you have to invest in an opportunity zone deal?

180-Day Investment Period

Generally, you have 180 days to invest an eligible gain in a QOF. The first day of the 180-day period is the date the gain would be recognized for federal income tax purposes if you did not elect to defer the recognition of the gain.