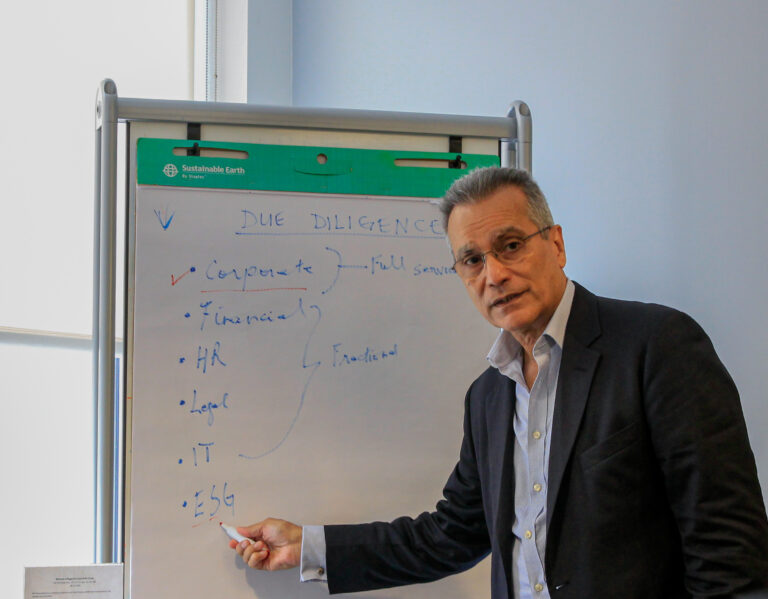

Due Diligence and Valuation

During the due diligence and valuation process, Lions Financial helps clients create the comprehensive plan and business valuation based on the company’s unique character. Lions Financial can provide you with a holistic solution to create value during the investment underwriting period.

Our expertise

Due diligence and valuation of a company is part of an examination that provides a reasonable investigation on important matters and qualifies a business’s financial value. It helps to have a holistic approach when determining the metrics that are being utilized in understanding business and financial components in important transactions like Mergers and Acquisitions. When a purchasing company uses data to make decisions on the potential investment risk, the true value of the business needs to be thoroughly underwritten. A proper decision is difficult to be made without uncertainty if there isn’t thorough due diligence and confidence in the valuation, which are essential to determine whether the business price is suitable.

The Key Items to Know in Due Diligence and Valuation Process

Net worth

Asset Valuation

Historical Earnings Valuation

Relative Valuation

Future Maintainable Valuation

Discount Cash flow valuation

What Is The Work-Process Lions Financial Uses?

A Closed-Loop, Value-Focused, Four-Step SIRE© Work-Process For Each Of Our Services:

Step 1: Survey

Step 2: Insight

Step 3: Recommend

Step 4: Execute

A Due Diligence and Valuation Process Checklist:

Profitability Profile

Exploration potential in other assets:Contact Lions Financial to find a better strategy and holistic valuation for your business. Lions Financial helps Financial Institutions and Businesses, together with their tax and legal advisors, during the Due Diligence and Valuation period to make the optimal financial decisions for success. Contact us for an initial consultation to help determine how our team can help with your current business need.