什么是机遇区?

机会区是一个低收入的普查区,个人贫困率至少为20%,家庭收入中位数不超过该地区中位数的80%。

机会区是一种经济发展工具,允许人们在美国的贫困地区投资。其目的是刺激低收入社区的经济增长和创造就业机会,同时为投资者提供税收优惠。

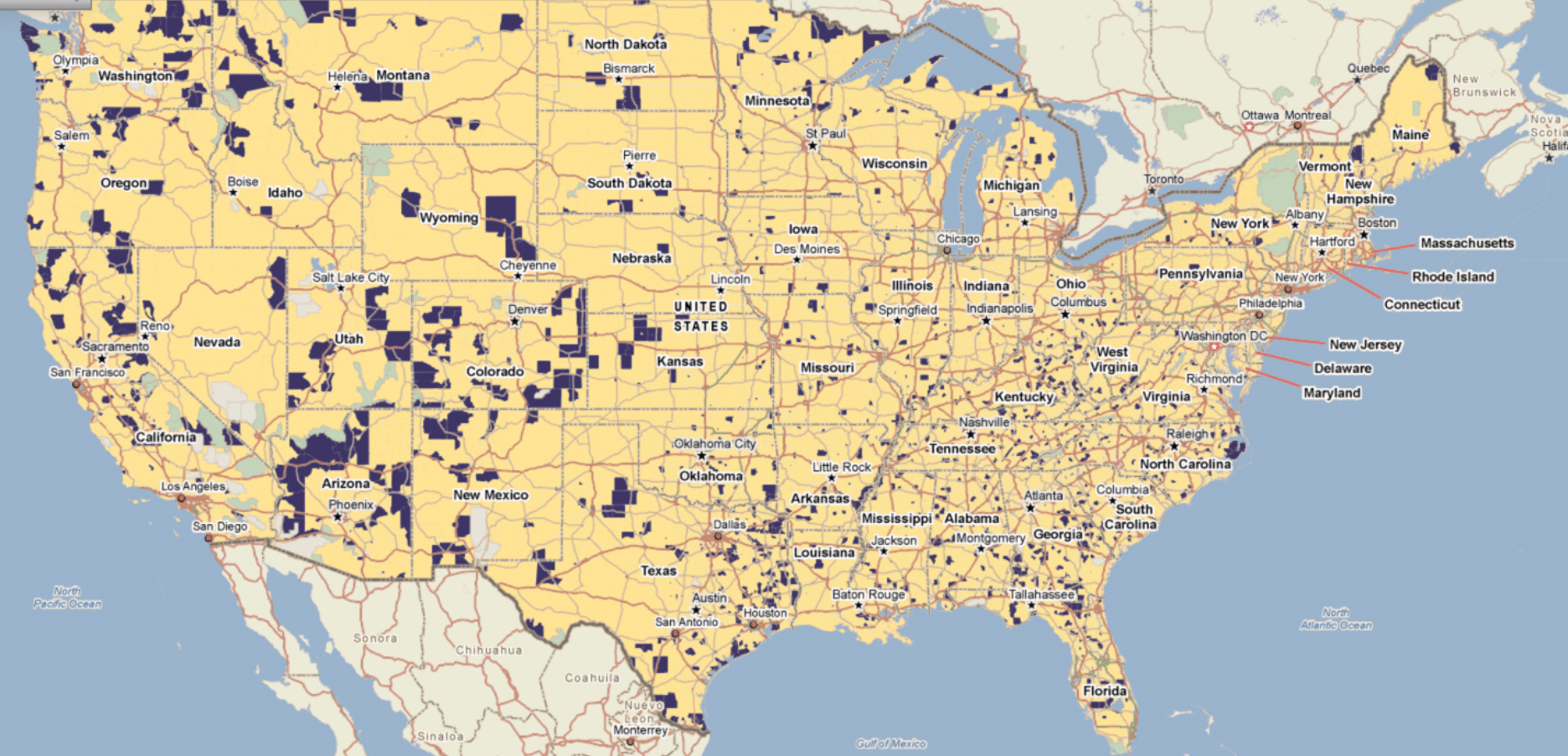

机会区是根据《2017年减税和就业法案》(公法第115-97号)设立的。所有50个州、哥伦比亚特区和五个美国领土上的数千个低收入社区被指定为合格的机会区。

纳税人可以通过合格的机会基金投资于这些区域。

资料来源。 政策地图

你如何有资格在机会区投资?

对于大多数OZ基金,你必须是一个合格的投资者--你必须有$1万的净资产,不包括你的主要住所,或者如果你是单身报税人,连续两年至少有$20万的年收入(已婚报税人为$30万)。

创建机会区基金的要求是什么?

国税局将机会区基金描述为一种投资工具,它提交了合伙企业或公司的联邦所得税申报表,并为投资于合格的机会区财产而组织。你可以从国税局获得并提交8896表,并创建一个合格的机会区基金。

它的结构可以是合伙企业或公司,只要其目的是通过房地产或通过股权投资于机会区的一个人口普查区。但请记住,该基金必须在机会区地区持有大部分资产--90%。

任何人都可以成立QOF,这就为支持投资者寻求庇护进入项目的资本收益的基金打开了大门。对于初创公司和企业来说,资本收益的数额实际上可能相当小,但必须有某种资本收益作为基础。

大部分合格的机会基金将是有限责任公司。现在,它可以是有限责任公司,也可以是公司或合伙企业,但大多数将是作为合伙企业纳税的有限责任公司。因此,真正重要的考虑因素之一是,当你设立合格机会基金时,你必须有两个成员。而且这些成员必须是不同的成员,有独立的雇员身份号码或纳税人身份号码。

一般来说,一个OZ基金必须将其资产的至少90%投资于位于合格机会区的企业。

如何投资于机会区基金?

参与机会区和它们提供的优惠税收待遇是通过将合格的资本收益放在机会基金中来实现的。机会基金是集合投资基金,遵循特定的要求以获得这一称号,有几种机会基金可供选择。

合格的资本收益可以通过出售股票、债券、私人企业或房地产实现。经认可的投资者可以参与机会区提供的优惠税收待遇,方法是在出售资产后180天内将其当前的资本收益转入合格的对外投资基金,此外还需提交IRS表格8949。非合格的资本收益资金也可以投资于机会区,但这些钱将没有资格获得同样的税收优惠。

合格的机会区基金是指结构为公司或合伙的私人基金,将其超过90%的资本投资于机会区。最近的一项裁决指出,基金未能满足90%的资产测试,不会取消他们被归类为机会基金的资格,但可能导致罚款。

政府没有使用纳税人的钱来刺激这些社区的经济增长,而是决定使用私人投资。为了鼓励私人参与,在合格机会区投资的个人有资格获得税收优惠。

为了利用这一计划,纳税人必须将其出售资产的收益(已实现的收益或资本收益)投资于合格机会区基金。这必须在出售后的180天内进行。然而,虽然纳税人可以投资出售资产的收益以及潜在收益,但税收优惠只适用于资本收益。

另外,值得注意的是,投资者可以使用任何升值资产的收益。这并不要求用同类资产投资来推迟潜在收益。

机会区的税收优势是什么?

该计划为在机会区投资未实现的资本收益提供三项税收优惠。

- 暂时延缓对以前赚取的资本收益征税。投资者可以将有累积资本收益的现有资产放入机会基金。这些现有的资本收益直到2026年底或资产被处置时才会被征税。

- 投资以前获得的资本收益的基础递增。对于放在机遇基金中至少5年的资本收益,投资者的原始投资基础增加10%。如果投资至少7年,投资者的原始投资基础将增加15%。

- 对新的收益永久免征应税收入。对于持有至少10年的投资,投资者通过投资机会基金产生的任何资本收益都无需纳税。

在机会区投资的风险是什么?

与任何投资一样,投资于机遇区也有风险。最大的是在该区投资的可行性。仅仅因为有税收优惠政策将资金放在某些地区,并不意味着每项投资都能获利。投资的地点和类型很重要。寻找一个在不同机会区拥有多样化资产的基金。

此外,为了让投资者充分利用机会区提供的税收优惠,他们需要将部分资本收益转入机会基金。这可能会减少投资者在此期间的投资组合的多样化,这可能会增加风险暴露。

现在说这些OZ基金将带来什么样的收益(如果有的话),或者哪些OZ基金值得投资,还为时过早。事实上,关于OZ基金可以投资什么以及它应该如何运作的规则仍在不断发展。这可能会造成一个问题:一个OZ基金必须遵守美国国税局的无数准则。如果不遵守,它可能不得不支付罚款,或者更糟的是,基金的投资者将没有资格享受资本收益税的减免。要明白不良房地产交易本身是有风险的。你购买的是一个人们不愿意投资的领域。

OZ基金没有什么业绩记录,经理人没有经验,费用高,进入门槛高,不适合退休储蓄或你不能忍受损失的钱,也不适合在规定的持有期锁定。它们更适合财力雄厚、精明的投资者,而不是小市民的储蓄者。如果你从来没有投资过私募股权或你是少数投资者的密切控股投资,这些可能不适合你。

你可以在机会区基金中投资什么类型的资产?

该基金可以投资于任何合格的资产,可以是不动产、设备,或者是50%或更多收入来自机会区的企业。根据目前的准则,许多种类的企业都符合条件,但有一些企业,包括高尔夫球场、按摩院、赌场和酒类商店,被排除在外。

有哪些法规来保护投资者?

- 让更多类型的收益有资格获得减税。在可能是最终条例中最有利于投资者的变化中,企业的投资者可以推迟对更多类型的收益征税--特别是出售某些企业资产如房地产或重型设备的收益。根据税法的正常规则,企业将其出售这些资产的收益和损失结合起来。他们在某一年的销售净收益导致资本收益,企业为此支付资本收益税,而净损失让企业从其普通收入中扣税。这意味着,企业通常必须等到年底才能确定他们的总体收益或损失,拟议的法规将遵循这种方法。但是,根据最终的规定,企业可以自行计算每笔销售,使他们获得两方面的好处:他们可以为每笔收益获得机会区的减税,他们可以为每笔损失获得全额扣除。

- 让企业持有现金的时间更长,让社区等待。为了防止投资者仅仅通过将现金存放在银行而不是将资金投入到这些社区而从机会区的税收减免中获益,法律限制了符合条件的企业可以持有的现金数量。但是,拟议的法规包括一个慷慨的例外,让企业有资格获得税收减免,即使他们以现金持有所有资产长达31个月。现在,最终的法规极大地扩展了这一例外情况--让一些企业有资格获得税收减免,而无需在机会区进行超过五年的实际投资。

你要在机会区交易中投资多长时间?

180天的投资期

一般来说,你有180天的时间将符合条件的收益投资于一个QOF。如果您没有选择推迟确认收益,180天的第一天就是该收益在联邦所得税方面的确认日期。