Lions Financial focuses on helping companies in the business insurance industry through capital markets financing and business consulting engagements. We have compiled a brief overview of Berkshire Hathaway’s investments over the years and its business Risk Management considerations.

Berkshire Hathaway is an American multinational conglomerate holding company headquartered in Omaha, Nebraska, United States. The company wholly owns GEICO, Duracell, Dairy Queen, BNSF, Lubrizol, Fruit of the Loom, Helzberg Diamonds, Long & Foster, FlightSafety International, Pampered Chef, Forest River, and NetJets with their managements, and also owns significant minority holdings in U.S. public companies Kraft Heinz Company, American Express, Wells Fargo, The Coca-Cola Company, Bank of America, and Apple.

Berkshire Hathaway is controlled and led by Warren E. Buffett, who is the chairman and CEO of Berkshire Hathaway, and by Charles Thomas Munger, who is one of the vice chairman of Berkshire Hathaway as Warren Buffett’s partner. Early in his career at Berkshire Hathaway, Buffett engaged in long-term investments in publicly traded companies, but recently he has acquired the entire company more frequently. Berkshire now has a variety of businesses including confectionery, retail, railroads, furniture, encyclopedias, vacuum cleaner manufacturers, jewelry sales, uniform manufacturing and distribution, and electric and gas utilities in some regions.

Berkshire Hathaway Class B stock has been at times the eighth-largest component of the S&P 500 index. The company is famous for getting hold of the highest share price in the history of the New York Stock Exchange with Class A shares.

There are currently 16 people on the board of directors of Berkshire Hathaway, which consist of 5 Executive Directors and 11 Non-Executive Directors. The average age of the board is 72.8, and 75.8 for the Executive Board, 72.9 for non-executives. With the relatively old average age in the Executive team, one risk revealed in the annual report 2019 is that the company is “dependent on a few key people for our major investment and capital allocation decision” An unexpected change to Warren E. Buffett and Charles T. Munger specifically can have a negative effect on the company. Both of them claim to have good health conditions but the company seems to lay a potential succession plan to mitigate the risk.

In 2018, Gregory Able and Ajit Jain were appointed to be the vice chairman of non-insurance operations and insurance operations. Top executives have stated that the company has prepared for the successor of Warren. Buffet has stated that he will not sell any Berkshire shares, and all of them will convert to Bs shares and distrust the various foundations on a scheduled distributed date. The non-executive and independent directors will continue to serve as guardians for protecting shareholders’ interests.

Source From: Fintel.io

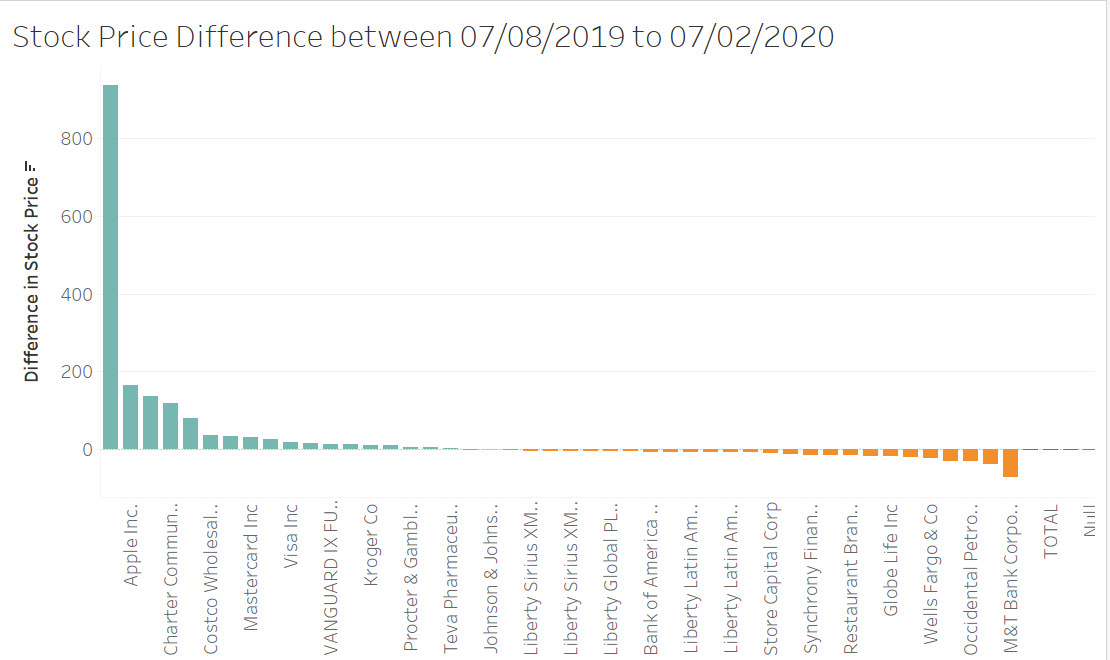

Berkshire Hathaway owns 46 companies’ publicly-traded U.S. stocks according to the data from Berkshire Hathaway 13F filing.

Source From : Fintel.io & Kip linger

Berkshire’s acquisition criteria set the basic rules of acquisition to the public. The company targets large purchases on companies with over $75 million of pre-tax earnings and consistent earning power. The company has to have good management as Berkshire does not provide it. Technology companies are not favored by Berkshire and Buffett.

Berkshire Hathaway has made over 65 acquisitions with information in the company 10-K and news forms the foundation of acquisition strategy analysis.

Performance

The company does not disclose financial reports on individual companies. Each year they give a performance analysis on important entities, but the analysis lacks consistent benchmarks and specific data. Therefore, it is hard to evaluate the effect of acquisition and determine whether or not the deal is successful.

Thought and Deal Process

Buffett uses the disclosed acquisition criteria to screen out a lot of unqualified candidates. Based on the available information on past acquisitions, the final decision is always based on Buffett himself and Charlie Munger, the vice president of Berkshire.

Amount and Payment Structure

The price is based on the acquirers themselves. Among the disclosed acquisitions collected, they are made in a combination of stock and cash, but some have been made with stock alone. Among the stock exchanges include RC Willey and Helzberg Diamonds which were both purchased with Berkshire stock exchange. Duracell and WPLG were made by an exchange of other companies’ stock. Precision Castparts and BNSF are among the disclosed private acquisitions.

General Re was also made in exchange for Berkshire’s stock. The General Re case is important because the transaction was finished by issuing 272,200 shares of new supplies. The price was at the company’s fair value then, this new issuance increased shares outstanding by over 20 percent. With the share price increase over the years, Berkshire shareholders “give far more than they receive” as Buffett wrote in his 2017 letter.

Dexter Shoes was another failed investment that was paid in stocks back in 1993. The company value went to nothing soon after the purchase. The $434 million stock used for purchase was worth $6 billion in 2016.

The great performance of Berkshire Hathaway is one advantage in acquisition. Its stock can be very appealing to potential acquirers and may convince them to sell the company at a discount. Based on the known information, Buffett is getting more reluctant to use stocks in purchases.

Industry

There are two types of acquisitions:

1) Sizable stand-alone acquisitions;

The first type of acquisition focuses on companies such as Precision Castparts and Fruit of the Loom, industries such as Clothing, Luxury items, and Food and Beverages. Although in the same industries, the companies within usually operate independently.

2) Bolt-on acquisitions that fit with businesses they already own.

The second type will be represented by insurance with eleven companies on the subsidiary list. It is apparent that Buffett has a list of industries that he prefers and understands. As stated in the acquisition criteria, the industries are fairly traditional and without advanced technologies to use in industry guidelines.

Berkshire Hathaway will identify their risks, for example in the 10K of 2019, where the company lists the issues it is facing with the below risks.

- “We depend on a few key people for our major investment and capital allocation decisions.”

- “We need qualified personnel to manage and operate our various businesses.

- “Investments are unusually concentrated in equity securities and fair values are subject to lose in value.”

- “Competition and technology may erode our business franchises and result in lower earnings.”

- “Deterioration of general economic conditions may significantly reduce our operating earnings and impair our ability to access capital markets at a reasonable cost.”

- “Terrorist acts could hurt our operating businesses.”

- “Regulatory changes may adversely impact our future operating results.”

- “Cyber security risk”

Risk Unique to regulated businesses

- “Our tolerance for risk in our insurance businesses may result in significant underwriting losses.

- “The degree of estimation error inherent in the process of estimating property and casualty insurance loss reserves may result in significant underwriting losses.”

- “Changes in regulations and regulatory actions can adversely affect our operating results and our ability to allocate capital.”

- Market Risk includes Equity Price Risk, Interest Rate Risk, Foreign Currency Risk, and Commodity Price Risk.

Source From: 10k

Strength

Attractive investment:

Warren Buffet is known for his wise investment choices. Investors like to follow his investment decisions. Berkshire Hathaway’s recent rapid growth in net income is also the result of the chairman’s financial acumen. Buffett also bought a large share of Apple. Several other investments made by Berkshire Hathaway have also achieved impressive results, including Coca-Cola. Berkshire Hathaway also made some other major investments, including American Express, Bank of America, and Wells Fargo.

Low capital cost:

With sufficient cash and no debt on the balance sheet, as well as providing a cheap floating well-operated insurance business, Berkshire’s remaining capital has been growing rapidly, As long as such low-cost capital exists, Berkshire can provide its unique approach. This will provide a competitive position for the company’s investment business. The best investment holding period is forever, and the best corporate strategy is long-term.

Various business combinations:

Berkshire Hathaway is a holding company, mainly investors, but the brand also owns several companies. As mentioned in the introduction, it has more than 60 companies, including Geico, Dairy Queen, and Duracell. The largest of its subsidiaries are the insurance business, freight transportation business, public utilities, energy generation, and distribution business.

Reputation:

Buffett’s reputation has been increasing the brand equity of Berkshire and its acquisition and investment companies. Buffett-invested company will receive important publicity worldwide, such as a powerful marketing campaign.

Weakness

Decisions are limited to a few people:

Only 25 people work in the headquarters, and fewer people can make decisions. Although it reduces the chance of errors on the one hand, it has some disadvantages on the other. Because of the lack of obeying the consultant. Some of his investment choices did not produce the best results.

Investment mistakes:

Warren Buffett was able to make several significant and important acquisitions. However, not all acquisitions he made were successful. He missed several important investment opportunities.

Berkshire’s board of directors has weak risk monitoring.

Opportunities

Investment technology brand

Technology is currently the hottest industry. With the exception of Apple, Berkshire Hathaway rarely invests in technology labels. Playing cards carefully is a good financial strategy, but sometimes you hate caution. The growth rate of these technology brands exceeded expectations. In the long run, investing in new technology brands can also generate considerable returns.

Threats

Regulatory threats:

In the United States and abroad, the regulatory framework has changed significantly in response to economic and financial crises and other issues. The supervision of financial institutions has also greatly increased, leading to higher compliance and operating costs and greater overall pressure. These factors will affect Berkshire’s insurance business revenue, net profit, and other businesses.

Source From Investopedia

Lions Financial works with company issues around capital initiatives that require Due Diligence, Valuations, Mergers and Acquisitions, and Business Exits. We focus on industries such as automotive, trucking, commercial real estate, hospitality, retail & e-tail, financial services, biopharmaceuticals, healthcare, marketing, advertising, engineering, and renewable energy companies.

In terms of its risk management considerations, Berkshire Hathaway has a reputation for being a highly conservative investor. The company has historically avoided investing in highly volatile sectors or companies with significant risks, preferring instead to focus on companies with strong fundamentals and reliable earnings. Additionally, the company has a highly disciplined approach to managing risk, including a focus on diversification, rigorous due diligence, and maintaining ample cash reserves to weather any potential downturns.