Lions Financial is committed to providing comprehensive financial services and support to businesses and financial institutions. In the case of Air Canada, we can offer an overview of the airline company’s financial position and assist in evaluating its financial performance, potential risks, and opportunities.

Our team of financial experts will analyze Air Canada’s financial statements, including balance sheets, income statements, and cash flows, to gain insights into the company’s profitability, liquidity, and solvency.

Air Canada is Canada’s largest airline and the latest provider of scheduled passenger services in the Canadian market, the Canada-U.S. transborder market and in the international market to and from Canada. In 2019, it was among the top 20 largest airlines in the world. Air Canada is a founding member of Star Alliance™ providing the world’s most comprehensive air transportation network.

Air Canada’s predecessor, Trans-Canada Air Lines (TCA) inaugurated its first flight on September 1, 1937. The 50-minute flight aboard a Lockheed L-10A carried two passengers and mail between Vancouver and Seattle. By 1964, TCA had grown to become Canada’s national airline; it changed its name to Air Canada. The airline became fully privatized in 1989. Air Canada shares are traded on the Toronto Stock

Exchange (TSX:AC), and effective July 29, 2016, its Class A variable voting shares and Class B voting shares began trading on OTCQX International Premier in the US under the single ticker symbol “ACDVF”.

Air Canada is among the 20 largest airlines globally. Its corporate headquarters are located in Montreal.

Amee Chande

Amee Chande is a corporate director and strategy consultant. Ms. Chande sits on the boards of Algonquin Power and Utilities Corp, and Thumbtack, and serves on the Advisory Board of Livingbridge Private Equity. She is also a senior advisor to leading companies in the mobility sector such as ChargePoint.

Gary A. Doer

Gary A. Doer is a corporate director. Mr. Doer is a director of Great-West Lifeco Inc., IGM Financial Inc. and Power Corporation of Canada. He is also Senior Business Advisor to the law firm Dentons Canada LLP.

Christie J.B. Clark

Christie J.B. Clark is a corporate director. Mr. Clark is a director of Loblaw Companies Limited and SNC-Lavalin Group Inc. and a trustee of Choice Properties Real Estate Investment Trust.

Rob Fyfe

Rob Fyfe is a corporate director. Mr. Fyfe is Chairman of Michael Hill International Limited. He is also a Special Advisor to the Prime Minister of New Zealand on New Zealand’s COVID-19 response and recovery plan and an honorary advisor to the Asia New Zealand Foundation.

Michael M. Green

Michael M. Green is Chief Executive Officer and Managing Director of Tenex Capital Management, a private investment firm. Mr. Green has a multi-industry investment and operations background in aerospace, transportation, telecommunications and software systems.

Jean Marc Huot

Jean Marc Huot is a partner with the Canadian law firm Stikeman Elliott LLP. His practice is focused primarily in the areas of corporate finance, mergers and acquisitions, corporate governance and securities law matters.

Madeleine Paquin

Madeleine Paquin is President and Chief Executive Officer and a director of Logistec Corporation, a North American marine and environmental services provider. She has held that position since January 1996.

Michael Rousseau

Michael Rousseau was appointed Air Canada’s President and Chief Executive Officer in February 2021. He previously was the airline’s Deputy Chief Executive Officer and Chief Financial Officer, a role held since January 2019.

Vagn Sørensen

Vagn Sørensen is a corporate director. Mr. Sørensen is Chairman of FLSmidth & Co. A/S, and serves as a director of CNH Industrial N.V. and Royal Caribbean Cruises Ltd. He also represents the private equity fund EQT in some of their portfolio companies.

Kathleen Taylor

Kathleen (Katie) Taylor is a corporate director. Ms. Taylor is Chair of the Board of the Royal Bank of Canada, Vice-Chair of the Adecco Group and a director of the Canada Pension Plan Investment Board.

Annette Verschuren

Annette Verschuren is Chair and Chief Executive Officer of NRStor Inc. The company develops and manages energy storage projects. From 1996 to 2011, Ms. Verschuren was President of The Home Depot Canada where she oversaw the company’s growth from 19 to 179 Canadian stores and led its entry into China.

Michael M. Wilson

Michael M. Wilson is a corporate director. Mr. Wilson is Chair of Celestica Inc. and Suncor Energy Inc. Mr. Wilson is the former President and Chief Executive Officer of Agrium Inc., a position he held from 2003 until his retirement in 2013.

In addition to new planes, the airline is introducing new routes and destinations in an effort to truly position itself as an international carrier – not only for Canadians, but for travellers from around the world to get from point A to B.

Landry explained. “Air Canada is going to need to become a global player – a global carrier of choice, an airline like a KLM or Air France or British Airways that attracts not just local markets but global travellers.”

As a result of this and a period of reflection, notable transformations include the aesthetic of aircraft interiors; for example a new colour pallet that moves away from the blue and reds that were previously dominant and instead, having charcoal gray as the primary colour, which Landry said is more premium and works in favour of a global position.

Air Canada’s international growth has focused on two specific strategies: competing effectively in the leisure market to and from Canada (which has been accomplished with Rouge) and tapping sixth freedom traffic via Air Canada’s international gateways, especially Toronto and Vancouver but also Montreal and Calgary.

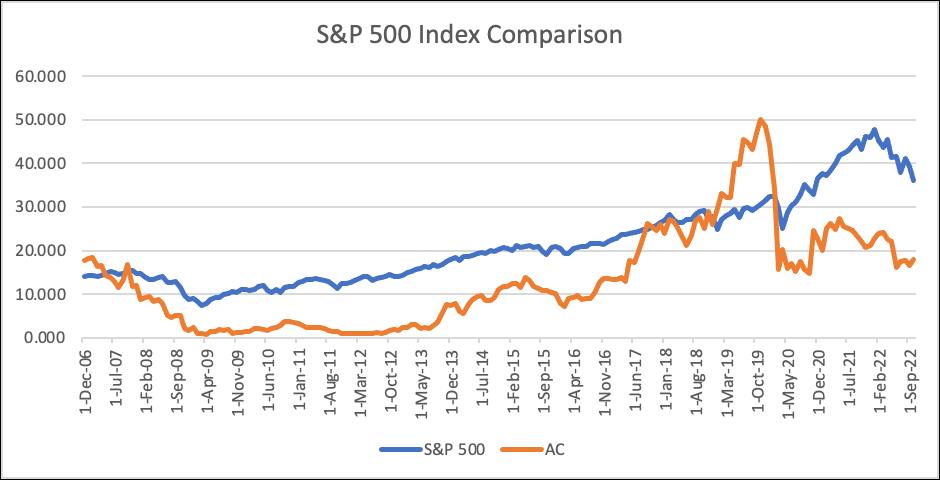

Stock Price Since IPO

IPO on November 24, 2006, on Toronto Exchange. Air Canada completed its initial public offering pursuant to which an aggregate of 9,523,810 Class A Variable Voting Shares and Class B Voting Shares were issued from treasury by Air Canada for gross proceeds of $200 million. In addition, ACE Aviation Holdings Inc., the parent company of Air Canada, completed a secondary offering of an aggregate of 15,476,190 Class A Variable Voting Shares and Class B Voting Shares of Air Canada for gross proceeds of $325 million.

Market Cap

- As for November 24, 2006, the market cap was 1.93 billion Canadian dollars and the stock price closed at $18.75/ share

- Market Cap fluctuated and increased to the peaks of 13.74 billion Canadian dollars on January 13, 2020

- As for today, October 5, 2022, it priced at $17.86/ share and has a market value of 6.38 billion Canadian dollars with a share outstanding 63.81M

- As for July 1, 2022, it has a total outstanding share of 407B

Stock Price

- IPO on November 24, 2006, on Toronto Exchange, with a stock price of $18.75 per share

- Stock price reaches peak of $50.05 around November 2019 with a 167% growth since IPO

- As for today, October 5, 2022, the stock price is $17.86/share with a drop of 4.74% since IPO

- The average stock price since IPO is $13.27/share with a volatility of 11.23

- The average stock price return since IPO is 1.75% with a volatility of 18.12%

- The moving average stock price with 5, 20, 50, 100, 200 days and a year period is on the following table:

| Period | Moving Average | Price Change | Percentage Change |

|---|---|---|---|

| 5-day | 17.41 | -0.15 | -0.87% |

| 20-day | 18.12 | -0.22 | -1.21% |

| 50-day | 18.15 | -0.53 | -2.83% |

| 100-day | 18.41 | -4.44 | -19.42% |

| 200-day | 20.63 | -4.29 | -17.22% |

| Year-to-Date | 21.11 | -2.85 | -11.12% |

- As for today, October 6, 2022, the P/E ratio is -1.83 with -12.02% change compared to 2021

- At the end of 2021, the P/E ratio is -2.08 with 47.52% change compared to 2020

- At the end of 2020, the P/E ratio is -1.41 with -115.90% change compared to 2019

- At the end of 2019, the P/E ratio is 8.87 with -79.03% change compared to 2018

| P/E Ratio | ||

|---|---|---|

| Year | P/E ratio | Change |

| 2022 | -1.83 | -12.02% |

| 2021 | -2.08 | 47.52% |

| 2020 | -1.41 | -115.90% |

| 2019 | 8.87 | -79.03% |

| 2018 | 42.3 | 1122.54% |

| 2017 | 3.46 | -20.09% |

| 2016 | 4.33 | -55.08% |

| 2015 | 9.64 | -71.31% |

| 2014 | 33.6 | -91.02% |

| 2013 | 374 | 9564.08% |

| 2012 | 3.87 | -458.33% |

| 2011 | -1.08 | -111.96% |

| 2010 | 9.03 |

Source from Market share

1. Composite Index

The data image of S&P500 and TSX.AC are obtained. The comparison shows that the S&P500 has a small fluctuation, and the overall trend is stable. Generally, AIR Canada stock price follows the similar trend of S&P500 Index, while TSX.AC witnessed an extreme drop of price early 2020, because of Covid-19, meaning that TSX.AC is much more sensitive to this pandemic compared with S&P500.

To further explore the correlation between S&P500 and TSX.AC, the comparison between S&P500 and TSX Composite should be considered. The data image of S&P500, TSX Composite and TSX 60 are obtained. During the last one-year historical data, the comparison shows that the grand market index such as TSX Composite and TSX 60 demonstrates a slight adverse trend of the S&P500 index. TSX Composite and TSX 60 witnessed a slight downside.

The data image of AWAY index, JRNY index, CRUZ index, OOTO index and TSX.AC are obtained, which describes a strong correlation between AIR Canada stock price and these influential travel index.

AWAY index: ETFMG Travel Tech ETF

CRUZ index: Defiance Hotel Airline and Cruise ETF

OOTO index: Direxion Daily Travel & Vacation Bull 2X Shares

JRNY index: ALPS Global Travel Beneficiaries ETF

3. Competitor Index

As most of the Canadian Airlines are not listed, we selected American Airlines, Alaska Airlines and United Airlines as the main competitors. American Airlines, Alaska Airlines and United Airlines are heavyweights in the air travel company index, so their stock indexes haven’t changed much. Compared with those airlines companies in the US, AIR Canada shows a similar slight downside trend during the last one-year time.

Target Customers:

- Upper middle class/ Businessmen

How to acquire target customers:

- Engaging customers by continually enhancing their travel experience and by consistently achieving customer service excellence.

- Elevate its customers, and support the creation of meaningful customer experiences and human connections by leveraging innovations in technology, loyalty and products.

Types of marketing used to increase brand recognition:

Product Marketing:

- Largest fleet and passenger carrier in Canada.

- Subsidiaries as a part of its marketing mix product & service like: Air Canada Cargo, Air Canada Vacations, Air Canada Rouge, Air Canada Express, Air Canada Jetz.

- Offers business, premium economy and economy classes to its customers.

- Operates Maple Leaf Lounges across the world where access is complimentary for customers traveling by business class or to elite, platinum and gold members.

- Has a provision of a frequent flyers program wherein a customer can collect and spend points along with gaining status and rewards.

- A customer experience enhanced by competitive products and services, including the fully transformed Aeroplan program

Pricing Strategy:

A unique feature of lowest price guarantee wherein they claim that in case customers find a lower priced ticket elsewhere, within 24 hours of completion of a ticket purchase on their website, a promotion code valued at $50 along with the difference of price would be awarded to that customer.

e.g Air Canada Rouge, a lower-cost leisure carrier

Distribution Strategy:

- Headquarters located in Montreal in Quebec.

- 4 major hubs in Calgary, Montreal, Toronto and Vancouver.

- Toronto Pearson International Airport is the largest hub of the airlines.

- A global network, well positioned to meet demand from various customer segments, and enhanced by the airline’s membership in Star Alliance and by numerous commercial arrangements.

Promotional and Advertising Strategy:

- Created an online community of customers using social media platforms wherein they leave direct links to the app that have henceforth increased their usage.

- Started with hashtag campaigns this year and actively implemented it on various social media platforms till fall of 2018.

- Targeted to attract Canadians as well as non- Canadians who intend to travel in countries where they operate.

- Few examples of their popular campaigns are “Hello/Goodbye” in the 90s, “You and I were meant to fly” sung by Celine Dion. Their brand tagline ‘Your World Awaits’ invites the customers to experience their service.

- Digital Marketing: Instagram, influencers, hashtags.

Premium International Airline(TOP 50)

Market Share:

- Domestic: 7%

- S Transborder: 47%

- International: <2.6%

Company Rankings from industry Organizations:

#6-https://brandirectory.com/rankings/airlines/table

#33-https://www.worldairlineawards.com/worlds-top-100-airlines-2021/

#44-https://www.strategicobjectives.com/news/canadian-airlines-disappoints-global-ranking/

Strength:

- The Largest airline of Canada.

- Experienced workforce and a well-established infrastructure.

- Profitable international and business markets.

- Caters to over 170+ destinations globally.

- Nearly 35 million passengers fly with Air Canada annually.

Weakness:

- While brand awareness is high, brand affinity is low.

- Aging aircrafts in the fleet is a concern.

Opportunities:

- Flourishing tourism in Canada.

- Launch of low cost airlines.

- More penetration into global market by global brand awareness like top industry players.

Threats:

- The top 3 competitors of Air Canada:

- They compete for the same set of customers.

Company name: Canadian Airlines International Ltd

Date: January 1, 2001

Type: Horizontal Merger

Purchased price: $92Million

Industry Analysis:

Canadian Airlines International was Canada’s second-largest air carrier in 2001. After merging it, Air Canada became the world’s twelfth-largest airline in the first decade of the 21st century. However, when Air Canada gained access to Canadian Airlines International’s financial statements, officials learned that the carrier was in worse financial shape than was previously believed. An expedited merger strategy was pursued, but in summer 2000 integration efforts led to flight delays, luggage problems and other frustrations. However, service improved following Air Canada officials’ pledge to do so by January 2001. The airline was confronted by the global aviation market downturn and increased competition, posting back-to-back losses in 2001 and 2002.

Company name: Aeroplan(from Aimia)

Date: 10 January 2019

Type: Acquisition-Horizontal Merger

Purchased Price: $450million

Industry Analysis:

Aeroplan used to be a subsidiary of Air Canada. Air Canada sold Aeroplan to Aimia for a combined $688 million in 2008. On 11 May 2017, Air Canada announced it plans to launch a new loyalty program to replace Aeroplan and Altitude in 2020. On 10 January 2019, Air Canada re-acquired Aeroplan from Aimia for $450 million, for a profit of $238 million before expenses or inflation adjustments. Accounting for inflation yields a sale price of $832.2 in 2018 dollars, resulting in a profit of $382M before expenses. Air Canada received payments from TD and CIBC in the aggregate amount of $822 million. Visa also made a payment to Air Canada and assuming completion of the American Express agreement, AMEX will do likewise. In addition, TD and CIBC made payments to Aimia Canada Inc., now Air Canada’s subsidiary, in the aggregate amount of $400 million as prepayments to be applied towards future monthly payments in respect of Aeroplan Miles. Aeroplan is Air Canada’s frequent flyer rewards program. In 2020, Air Canada Altitude and Aeroplan merged, with Aeroplan as the surviving entity.

The air canada quantitative analysis is shown in detail below, there are some critical points from examining the financial reports:

- Air Canada has been benefited from the expansion and operation program since 2017

- Air Canada has suffered a detrimental loss during the covid time period

- The part that has been impact on the most is the shareholder’s equity

- Air Canada is not currently in a good financial position for investment

Balance Sheet (Liabilities):

From examining the balance, the conclusion can be drawn that the company is rather volatile throughout the years. The company has received some good investment returns from 2017 to prior to covid in the end of 2019, however, the cash on hand is not enough for them to survive covid. Therefore, some of the policy has been placed such as reducing workforce, freezing assets and taking out loans. After the covid restriction has been lifted, and operation has been resumed, the company is sinking in a deep financial trouble due to the payment of interest, restaff employees and mobilization of assets. As the balance sheet is shown above, the total equity has declined by over a billion within a year.

The consolidated statements of comprehensive loss has shown us the clear detail of the drastic decrease of shareholder’s equity. It provides some information of how and where the money went. It’s shown that the net loss has been very significant in the year 2020 and the shareholder’s equity has been compromised for the net loss.

The capitalization requirement is breaking down in detail throughout years since 2012. It has indicates that Air Canada will need a huge capital injection in order to be sustainable financial in the long run. The Debt to Equity ratio and Financial Leverage has been increase to the level of dangerous, yet the company only has 9 million dollars in total equity, which indicates that if the company has a slighest trouble with the cash flow in the future, it will inevitably default on its debt.

Air Canada has a rather inconsistent of debt to equity ratio due, but as it’s show it becomes normalized from the period 2016 to 2020, however, the impact from post covid time has some devastating effect on the company, which has shown in the D/E ratio.

Due to the troublesome financial statement report data, the break even analysis for Air Canada is shown that it will not likely to be breaking even in the foreseeable future, and it has not been breaking even since the start of Covid,

The Industry Average Valuation Multiples suggests that Air Canada had a average past performance compare to the industry, however, the recent year it has not been very profitable and the trend of this year is likely to carry out to the future.

The Cashflow statement has given investors some good indication of Air Canada has resume its operation, and it’s doing well recently compare to the last 2 years. However, the Cash flow from financing and investment activities are still remain concerning.