Q: What’s a must-have ability for a business in this COVID-19 era?

A: Adaptability. Proactive adaptability. Without it, a business remains poorly prepared. Struggling with each new surge of COVID-19. Result? Losses caused by supply-chain breakdowns, beside demand slowdowns. With it, a business can reach two key goals. One: Slash 40% off time-to-market with the right products and services. Two: Cut costs and expenses by 20 – 30%.

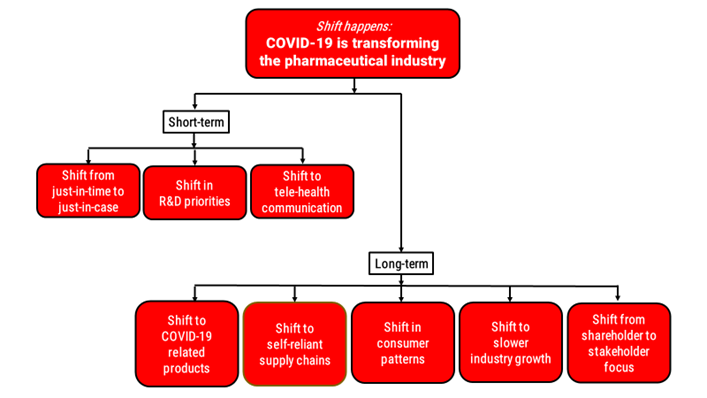

Q: How are new surges of COVID-19 affecting businesses that survived the first wave?

A: New surges of COVID-19 delay full and lasting recovery. If a business was at-risk before, it’s likely at higher risk now. This is made worse by the fact that recovery happens at different rates. Even in essential industry sectors. Consider healthcare. The margins of non-profit hospitals remain weak. Meanwhile, the margins of for-profit hospitals have improved. Old pharma is still being transformed. Meanwhile, new biotech is driving transformation. At any rate of recovery in any industry sector, proactive adaptability is vital.

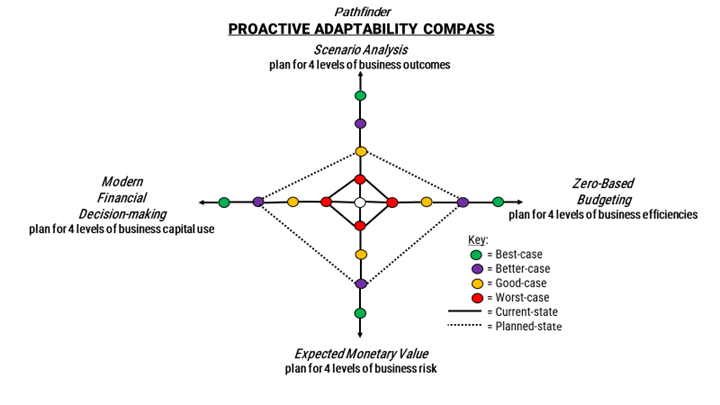

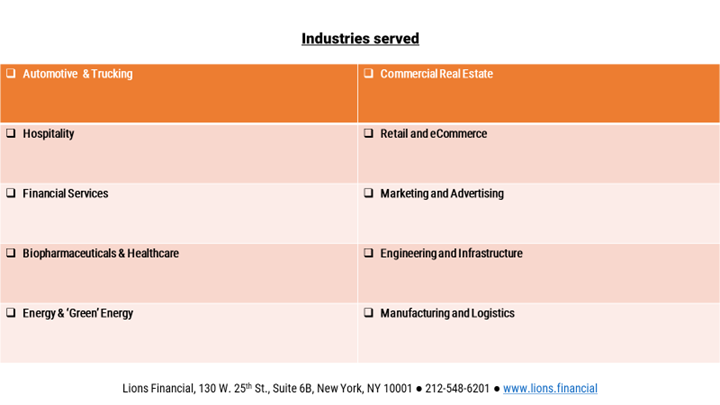

Q: How is Lions Financial now helping businesses with their planning needs?

A: We now offer full or fractionalized business planning services. We help business clients plan for the worst-case. Also, for the best-case. And anything in-between. We use 4 business planning tools to help. Scenario Analysis, to help plan for 4 levels of business outcomes. Zero-Based Budgeting, to help plan for 4 levels of business efficiencies. Expected Monetary Value, to help plan for 4 levels of business risk. And Modern Financial Decision-making, to help plan for 4 levels of capital use.

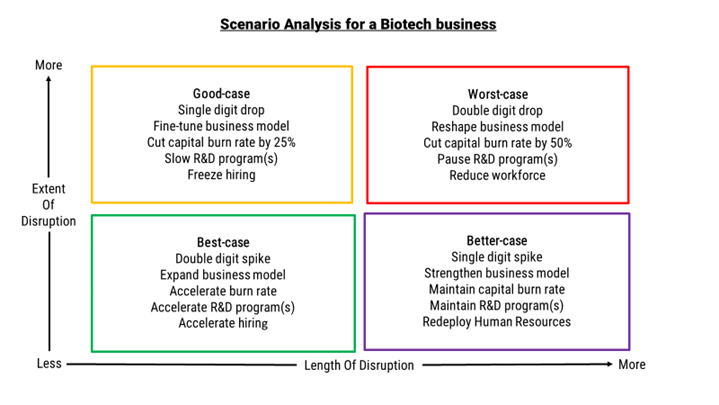

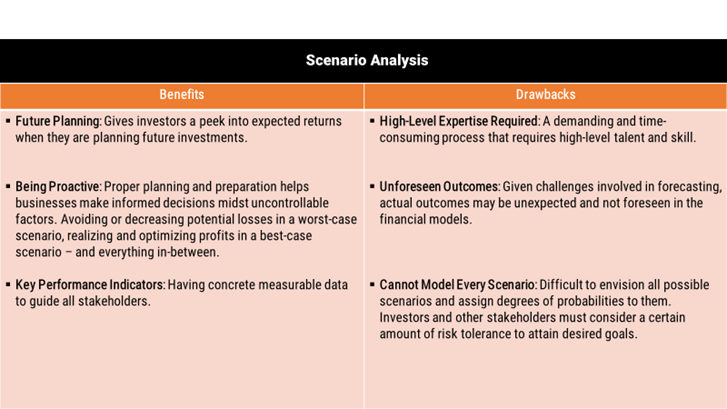

Q: What is Scenario Analysis? Why should a business use it?

A: It maps future outcomes for a business. It’s used to estimate changes in cash flow and net profit. This helps a business prepare, in advance, to manage various outcomes. So, business decision-making becomes less daunting and stressful. We help inform smarter business decision-making by using financial models, with relevant industry benchmarks.

Q: Why would a business flush with new investments, like a “hot” biotech, use this?

A: Even a “hot” biotech needs Scenario Analysis. To better tweak its business model. It’s capital burn rate. It’s R&D and HR decisions. Any “hot” tech business favored by investors today (and therefore more likely to be bypassed by competitors because COVID-19 has sped up the race for tech breakthroughs and application innovations) can quickly wind up unwanted tomorrow. Scenario Analysis helps any such business steer with more intelligence.

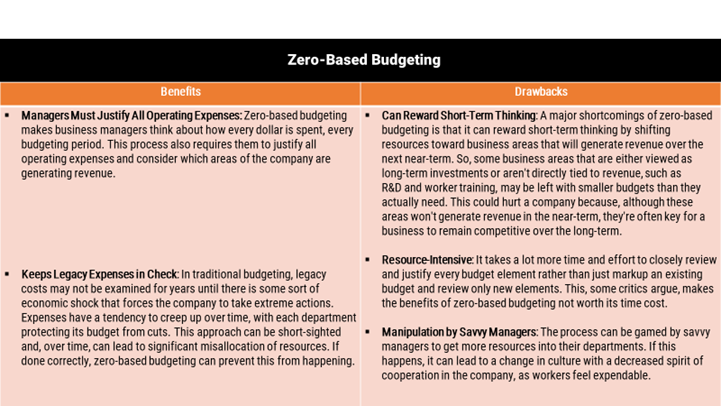

Q: What’s Zero-Based Budgeting? How different is it than traditional budgeting?

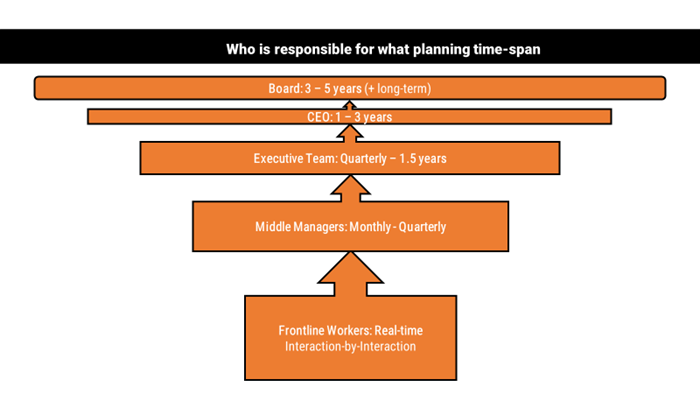

A: This process is a “participative budgeting” approach. It’s undertaken by every department and division of a business. One that commits to a shared business-wide “single source of truth.” It restarts at zero for each budget period. Info is examined at a granular line-item by line-item level. Then each budget is rebuilt. And synchronized with others. The priority is business necessity and efficiencies. Not mere markups of historical budgets. Resources needed must be justified, on an ongoing basis. Modern digital tools make it easier than ever to use. And cloud-based real-time dashboards provide more timely info. Crucial during this COVID-19 era.

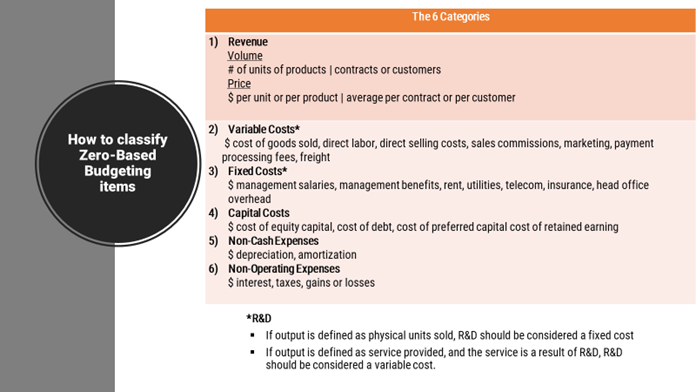

Q: What’s required when a business adopts Zero-Based Budgeting?

A: Step #1: Classify financial info in 6 categories. A common surprise: line-items (revenues, costs, expenses) in traditional financial statements were often misclassified or incorrect. By about 15 to 20 percent! Step #2: Correct all such info. Then pinpoint specific areas for process and operational efficiencies. During this crucial step: revenue-generation and cost-center business units collaborate. They set interdependent targets, with cooperative performance benchmarks. And they reallocate and synchronize individual budgets. Step #3: Use this info to rebuild new budgets from zero. Step #4: Measure actual outcomes. And ensure zero-based budgeting is embedded as the new standard business-wide.

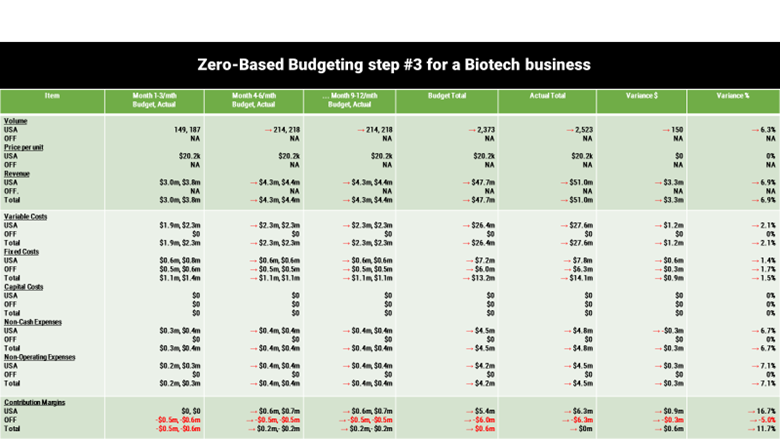

Q: Can you illustrate how Zero-Based Budgeting works for a business?

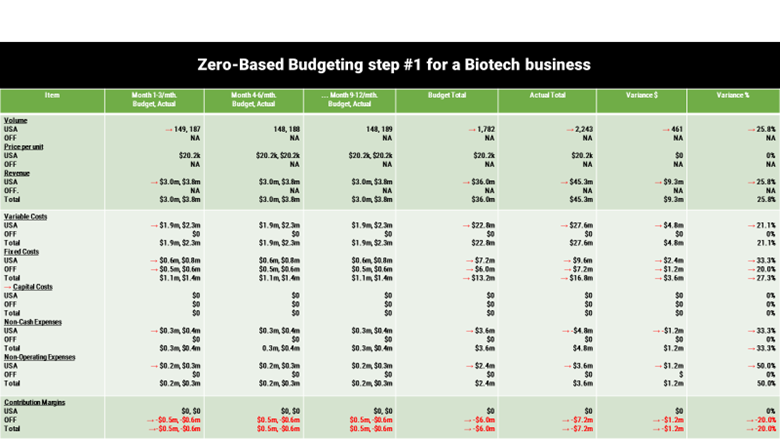

A: Consider an anonymized biotech startup, with an offshore R&D facility.

A: Step #1, we’re looking at a first quarter of actual results and projections. Opportunities to improve efficiency were flagged in all 6 financial categories. #1: Close the gap between budget forecast and actual revenue. Under-forecasting or over-forecasting revenue are common bad habits. This creates inefficiencies. And lost opportunities because of under-resourcing, or waste because of over-resourcing. Improving efficiencies became more urgent. Investors were increasingly concerned about COVID-19 disruptions delaying a liquidity event. So, a key goal was to improve revenue forecasts to within +/-2% of actual. This is in-line with best-practices at a publicly-held peer who uses a modern digital Customer Relationship Management tool. The negative impact of under-forecasting in this case prompted a re-balancing of Variable Costs, Fixed Costs, Capital Costs, Non-Cash Expenses, and Non-Operating Expenses.

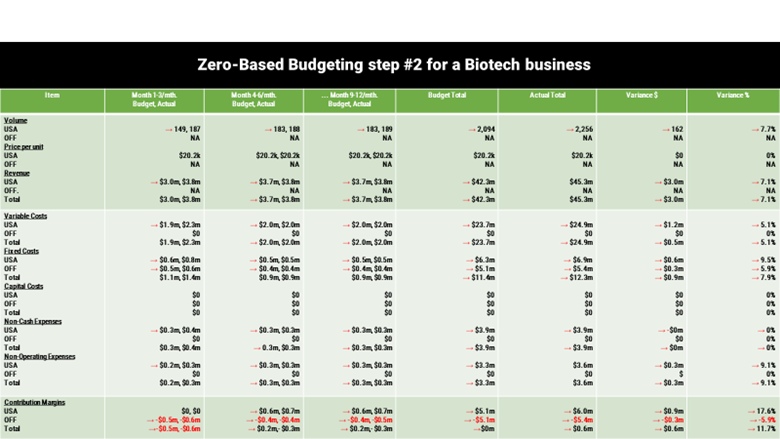

A: A pivot plan, starting in the second quarter, began by focusing on right-forecasting and right-resourcing double-digit growth, with re-balanced costs – and a positive bottom-line.

A: The pivot plan, starting in the second quarter, was fine-tuned. The goal: Become viable enough to compete for another round of needed investment capital in next 18-24 months.

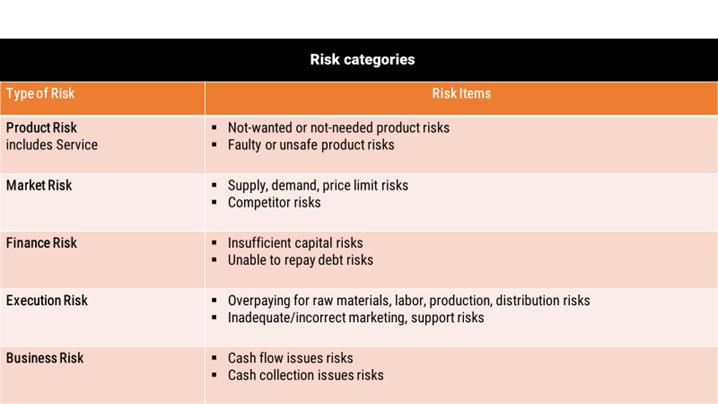

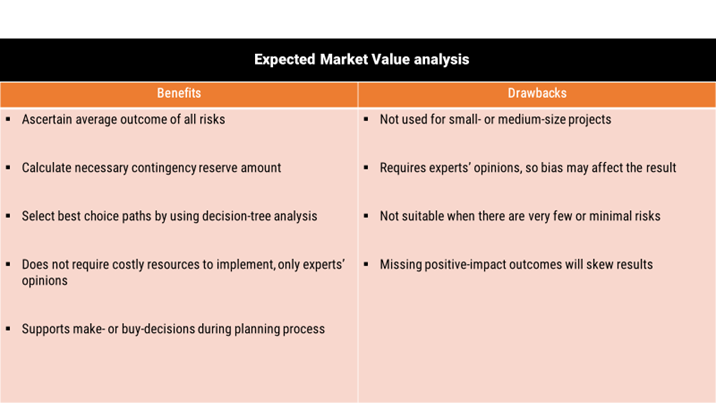

Q: What’s Expected Monetary Value? How is it used in business planning?

A: It’s about risk management. Calculated by multiplying the probability of an event occurring by the monetary impact of such an event. Risk is a natural part of business. And it’s even more important now, given the prolonged impact of COVID-19. It’s used mainly to guide business managers about how to plan for correct amounts required for contingencies.

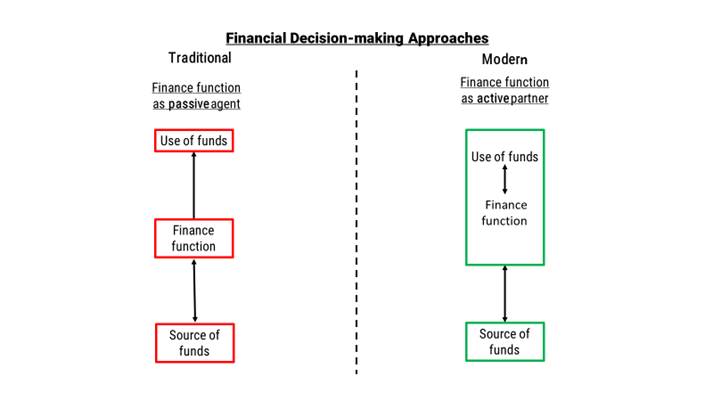

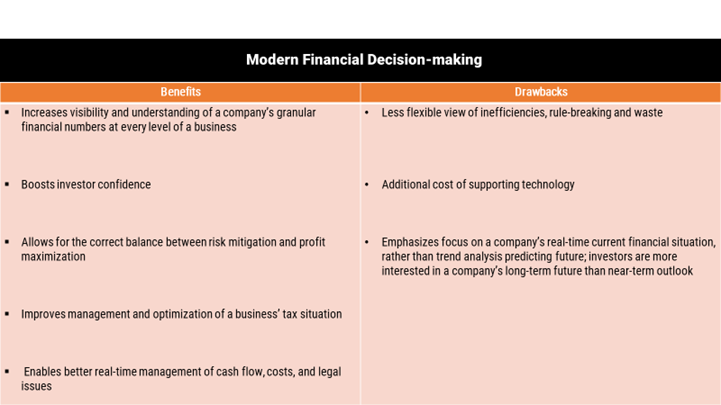

Q: What’s Modern Financial Decision-making? What’s different about it?

A: It about the same three traditional financial considerations of any business. 1: Investment decisions. 2: Financing decisions. 3: Dividend decisions. Difference here is that the finance function of a business goes beyond a traditional role. Beyond just procuring funds, for the most suitable terms. Here, corporate finance is more hands-on about effective use of funds. Needed because COVID-19 has made it harsher for sub-par use of funds.

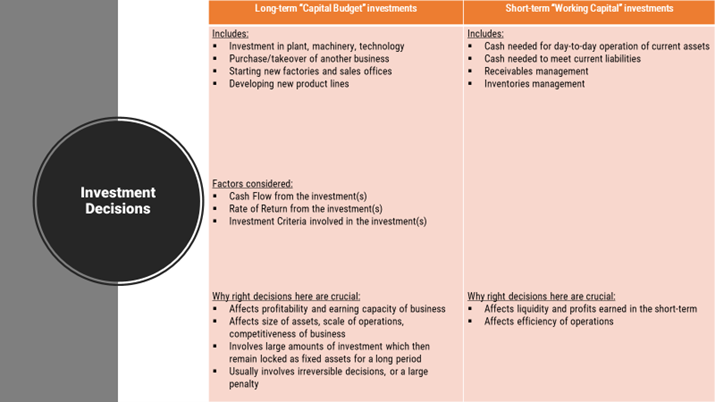

Q: What Investment decisions does a business make? Has COVID-19 compelled changes?

A: There are two kinds of investments a business makes in its assets. 1: Long-term investments, aka “Capital Budget” items. 2: Short-term investments, aka “Working Capital” items. The lingering impact of COVID-19 is making every business focus more on Short-term investments or “Working Capital.”

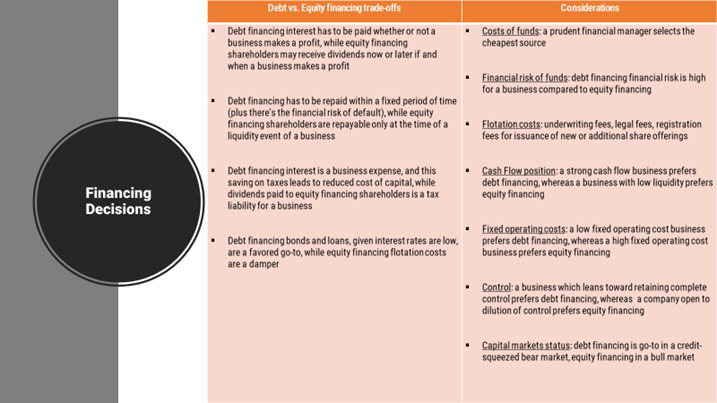

Q: What Financing decisions does a business make? Has COVID-19 forced changes?

A: This is about raising finance. Here too there are two kinds. 1: Debt finance, secured via corporate bonds issued, or loans taken. 2: Equity finance, gained from shares sold to the public (if it’s already a publicly listed company), or convertible shares offered to private investors (if it’s a startup or more mature privately held business). A debt-to-equity ratio of 1.5 or below is typical. Going over 2 is more typical for a capital-intensive business. Here too, the gnawing impact of COVID-19 is forcing most to rely on debt finance.

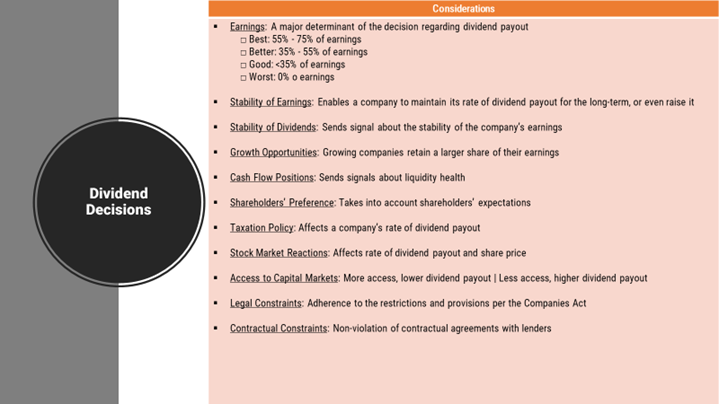

Q: What Dividend decisions does a business make? And what are typical considerations?

A: These is about the distribution of share of profits (after tax) to shareholders, as well as portion retained to further the growth of a business. There are about a dozen considerations here. See chart. The major one is earnings. And how much, ranging from 0% to 75%, a business is willing or able to give its shareholders.