Lions Financial is a consulting business that provides services to financial institutions and businesses during the Due Diligence and Valuation period. As for Aviva Aflac Ventures, it is a strategic venture capital arm of Aviva and Aflac. Aviva Aflac Ventures focuses on investing in innovative and disruptive startups in the insurance and financial technology sectors. They provide funding, industry expertise, and access to networks to help these startups grow and succeed in the market.

The venture arm of Aviva, Aviva Ventures, invests in a variety of early-stage InsurTech firms. Entrepreneurs with businesses that are strategically important to Aviva are offered access to the company’s global operations as well as financing.

Aviva Ventures, a London-based company, intends to invest £20 million annually in entrepreneurs working in four important sectors, including IoT, data analytics, innovative consumer offers, and digital distribution.

A VC division like Aviva Ventures will aid in protecting Aviva against emerging technologies that could jeopardize the company’s current operations. Comparatively to other market leaders who rely on internal R&D teams, Aviva can move faster, more flexibly, and more affordably thanks to the establishment of a venture arm. Being a strategic venture fund leaves the door open to earning lucrative returns in the future while also boosting demand for Aviva’s own products. Additionally, by venturing, Aviva will be able to look beyond its core competencies and investigate new opportunities that will allow it to quickly respond to customer requests, find and ensure novel types of risk, and make strategic decisions based on up-to-the-minute information.

Ben Luckett: Chief Innovation Officer.

Ben founded Aviva Ventures in August 2015 as a component of Aviva’s innovation strategy, and in January 2021 he was appointed Chief Innovation Officer.

Ben was the UKGI business’s Strategy Director prior to founding Aviva Ventures, and he currently serves on the boards of Founders Factory and Wealthify. He has also worked in finance and enterprise risk.

Ben worked as a senior marketing manager at Centrica before joining Aviva, where he was in charge of British Gas’ online channel. Ben began his work as a change management consultant at Accenture. For customers in the banking and insurance industries, he specialized in customer experience design.

Ant Barker: Head of Venture Investments & Partnerships.

Ant, a management accountant by trade, has experience in finance, business, change management, and venture capital in both small and large corporations.

Ant oversees Aviva’s investment activities through Corporate Venture Capital (Aviva Ventures) and technology funds. He also sits on the boards of several of their portfolio businesses.

Ant is excited about working with start-ups to assist accelerate their larger plan and challenge thinking at Aviva. Part of his responsibility is to ensure that they make use of the strategic intelligence and opportunities that come from being a part of the investment ecosystem.

Paul Welsh: Head of Group Innovation & Propositions.

Paul is a corporate intrapreneur with a background in starting start-up businesses, managing product portfolios, and launching new ideas. Paul has experience in the finance, insurance, energy, and service industries as well as marketing, business development, and proposition design.

Paul, who previously developed Centrica’s UK Innovation Lab, is passionate about identifying customer requirements and creating fresh, forward-thinking business concepts. He is concentrating on developing the appropriate organizational framework, talent pool, and culture to support innovation at Aviva.

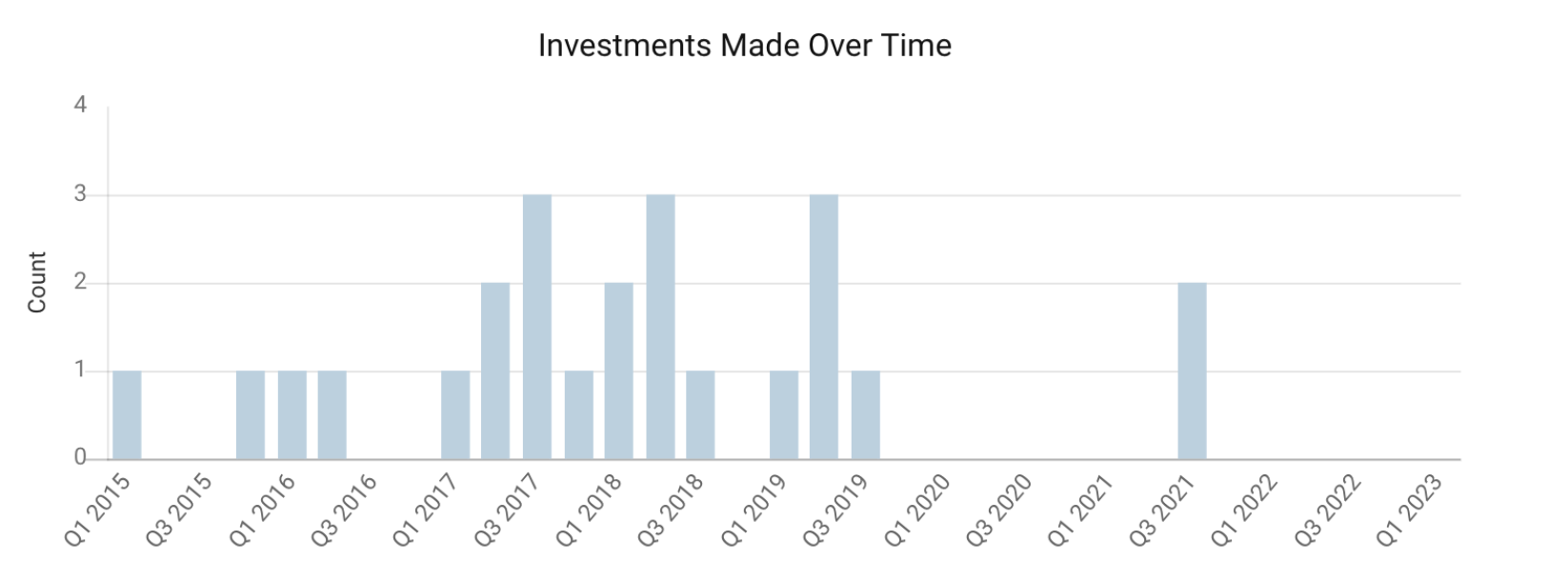

- 24 investments have been made by Aviva Ventures. Tembo Money raised £2.5M on August 5, 2021, marking their most recent investment.

- Two diversity investments have been undertaken by Aviva Ventures. On January 15, 2019, Outdoorsy raised $50 million, making it their most recent diversity investment.

- Four exits occurred for Aviva Ventures. The two most prominent exits from Aviva Ventures were Saari and Opun.

Source: Chrunchbase

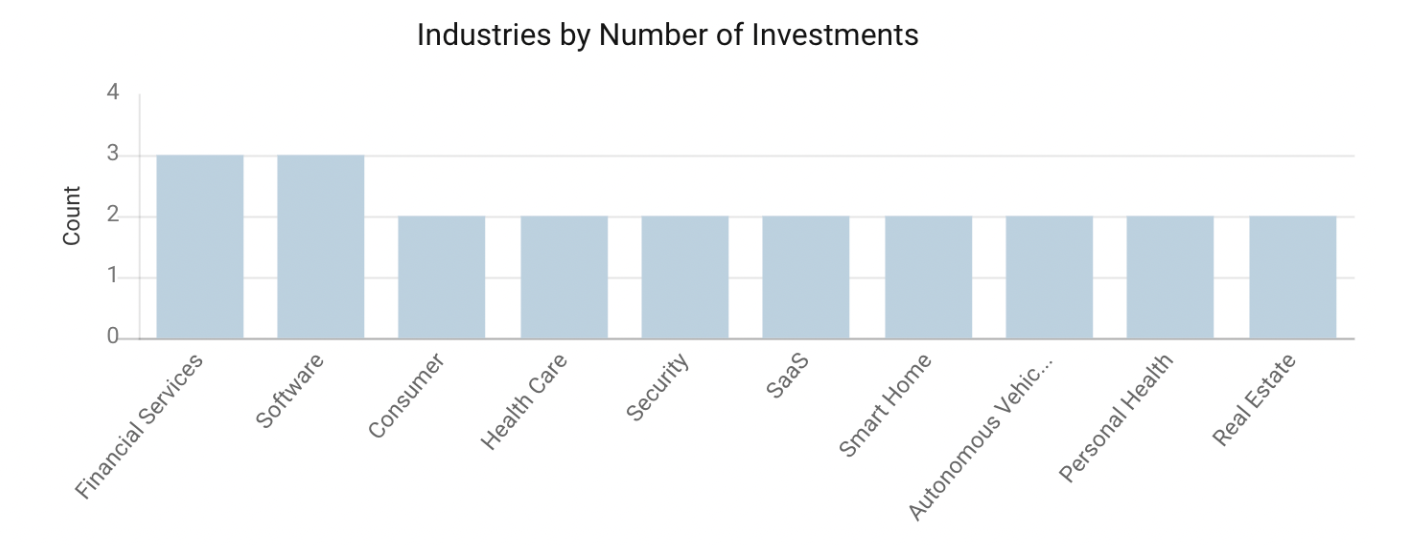

Industries distribution: Aviva Ventures has made 22 investments across 10 industries. Financial services and software are slightly more prevalent than other industries.

Source: Chrunchbase

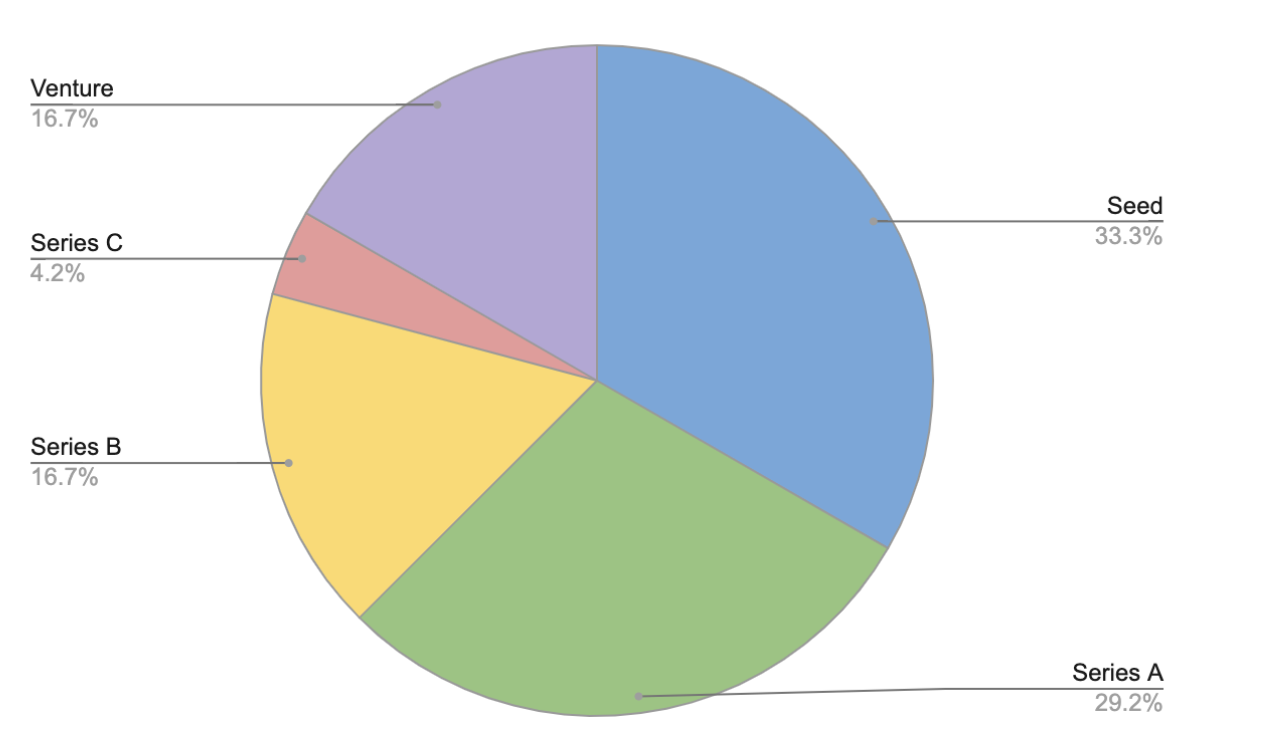

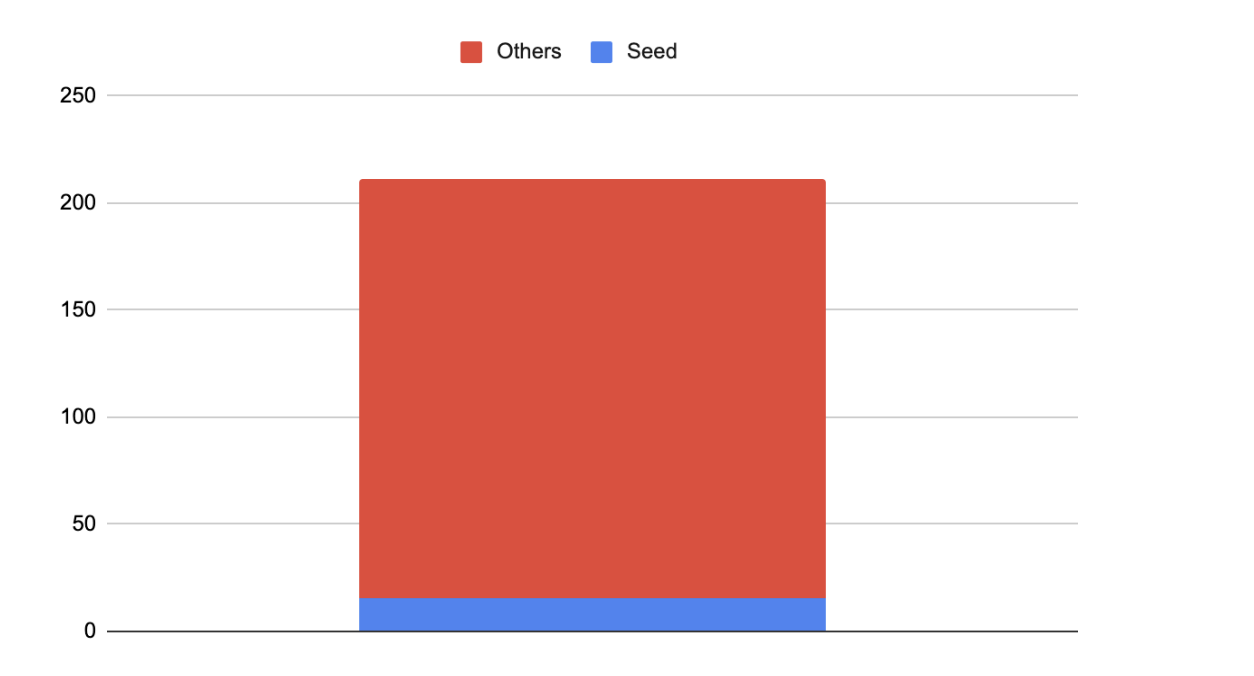

Stage distribution: Aviva Ventures invested at various stages, with the Seed round accounting for 33% of the total investment.

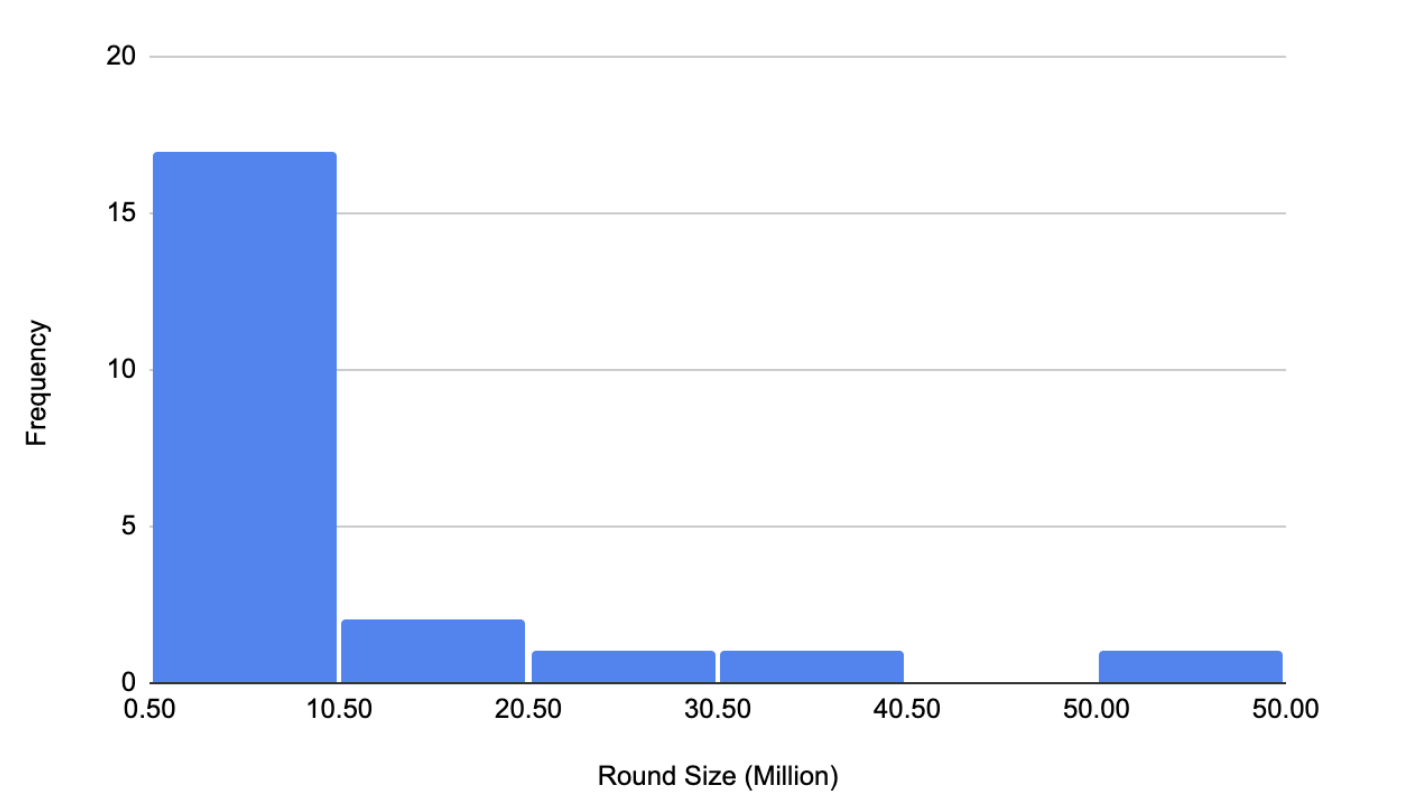

Round size distribution: Aviva invested a total of $210.88 million. The maximum investment is $50 million, while the minimum is $500,000. The majority of the investment is between 0 and 10 million dollars.

Investment Allocation: Although Aviva’s investment is primarily in the seed round, the seed round’s investment amount is extremely small in comparison to the total investment amount.

Aviva Investors is a global asset manager that combines insurance heritage, investment capabilities, and sustainability expertise to provide investors with the most important wealth and retirement outcomes. Aviva Investors manages £268 billion (2020: £260 billion) in assets, with Aviva Group managing £216 billion (2020: £209 billion).

The adjusted operating profit for Aviva Investors climbed to £41 million (from £25 million in 2020), indicating a 6% rise in revenues led by a 50% increase in real asset origination and higher asset levels as a result of positive net flows and favorable market movements.

With further advantages anticipated in the future, cost efficiency initiatives and business simplification reduced controllable costs to £345 million (2020: £356 million), excluding cost reduction implementation expenditures.

The cost-income ratio increased by 7pp to 86% (2020: 93%) as a result. In contrast to outflows of £1.1 billion in 2020, Aviva Investor’s net flows, excluding cash and liquidity funds, improved to £1.5 billion. This included net external flows, which increased by more than twofold to £3.3 billion (from £1.4 billion in 2020) and excluded cash and liquidity funds.

The favorable effects of net flows and markets were partially offset by the impact of corporate measures, including the sale of their US investment-grade credit capacity and fund rationalizations, which increased AUM by £7.5 billion in 2021.

Investment performance greatly increased, with AUM above the benchmark for up to 69% of one year (2020: 55%) and for up to 65% of three years (2020: 56%). As they continue to develop and deliver growth through their strengths in ESG, real assets, infrastructure, credit, and sustainable stocks, their trade momentum is still good.

Their joint ventures and associates in China, Singapore, and India are included in their international investments, which give them the opportunity to create wealth and have options in lucrative and quickly expanding markets. Due in large part to the inclusion of their minority stake in Aviva SingLife, which was formed on November 30, 2020, after the sale of Aviva Singapore, adjusted operating profit increased threefold to £97 million (2020: £26 million), and Solvency II OFG increased 97% to £124 million (2020: £63 million) (shown in discontinued operations for 2020). Due to the prosperous introduction of a new long-term care product in 2021, Aviva SingLife had high performance. This led to greater PVNBP of £1,122 million (2020: £664 million) and VNB of £78 million (2020: £29 million), together with stronger volumes and profits in China.

Biofourmis

Massachusetts-based Biofourmis is a worldwide health IT start-up that specializes in integrating digital therapeutics to deliver individualized care and treatments. Kuldeep Singh Rajput and Wendou Niu founded Biofourmis in 2015 in Boston, Massachusetts, and the company has now raised $43.6M in funding over seven rounds. A Series B round of funding was received by them on May 21, 2019. Eight investors are helping to fund Biofourmis. As of April 2020, Aviva Ventures and Openspace Ventures are the most recent investors.

The company’s platform makes use of artificial intelligence to integrate and analyze continuous physiology data from clinical grade wearables and to identify personalized patterns that can foretell a patient’s health deterioration, allowing medical professionals to take action days before a critical event.

Funding Timeline

August 10, 2016 – Biofourmis raises a $1,000,000 angel round from Eden Ventures.

May 1, 2017 – Biofourmis raises a $500,000 seed round.

December 2017 – Biofourmis raises a $5,000,000 series A round from Aviva Ventures and NSI Ventures.

May 1, 2018 – Biofourmis raises a $2,000,000 series A round from Aviva Ventures and SGInnovate.

May 21, 2019 – Biofourmis raised a $35,000,000 series B round from Aviva Ventures, EDBI, MassMutual Ventures, Openspace Ventures, and Sequoia Capital India.

September 2, 2020 – Biofourmis raised a $100,000,000 series C round from EDBI, MassMutual Ventures, Openspace Ventures, and Sequoia Capital.

April 27, 2022 – Biofourmis raises a $300,000,000 series D round from General Atlantic.

August 10, 2022 -Biofourmis Raises Additional Funding from Intel Capital in Series D Extension

Owlstone Medical

With an initial focus on lung cancer, liver illness, digestive health, and respiratory disease, Owlstone Medical is creating a breathalyzer for disease with a focus on non-invasive diagnostics for the early identification of disease and precision medicine. The company’s stated goal is to prevent 100,000 deaths and save $1.5 billion on medical expenses.

ReCIVA®, a unique sample-collecting tool that can take stable breath samples anywhere, is a component of the company’s Breath Biopsy® platform. The business’s commercial breath biopsy laboratory is based in Cambridge, United Kingdom, and is supported by a branch office in Research Triangle Park, North Carolina, USA. It has also created the largest digital breath biobank ever, which is matched to patient phenotype.

Funding Timeline

2004 – Owlstone Medical was founded by Billy Boyle and David Ruiz Alonso.

February 2016 – Owlstone Medical raises a $2,000,000 corporate funding round from V Ventures.

June 2016 – Owlstone Medical raises a $6,850,028 venture round from Medtekwiz Advisory.

January 2017 – Owlstone Medical raises an $11,500,000 venture round.

October 2018 – Owlstone Medical raises a $35,000,000 venture round from Foxconn and Horizons Ventures.

November 2019 – Thermo Fisher and Owlstone Medical collaborate for cancer diagnosis.

September 2021 -Owlstone Medical raises a $58,000,000 series D round from Horizons Ventures.

Shepper

Carl August Ameln, Ben Prouty, and Jan Vanhoutte, three serial entrepreneurs, launched Shepper in the last months of 2016. Shepper is an on-demand checking system, offering checks for businesses all around the world. It can swiftly and effectively check the assets using a network of experienced locals and a digital platform, providing cilents thorough results and dashboards right to their mailboxes.

Funding Timeline

2018 – Shepper raised $5.4M in Series A fundraising, with Aviva Ventures, Idekapital of Norway, and angel investors taking the lead roles.

2020 – Shepper raised £6M in second-round funding led by Aviva Investors.

Outdoorsy

A marketplace platform called Outdoorsy links RV owners and other campers. In November 2015, Outdoorsy joined the NFX Class 2 cohort and raised about $25,120,000.

The $32 billion recreational vehicle business has been disrupted by the peer-to-peer marketplace Outdoorsy. They make it simple and secure for qualified renters to transact with passionate RV owners.

By eliminating all the complexity and friction from the present user experience, they are revolutionizing the RV market. They give RV enthusiasts options and accessibility, as well as the chance for RV owners to generate a real income from renting out their vehicles.

Funding Timeline

June 2015 – Outdoorsy raises a seed round from Berlin Ventures.

February 2018 – Outdoorsy raises a $25,000,000 series B round from Altos Ventures, Autotech Ventures, Aviva Ventures, and Tandem Capital.

January 2019 – Outdoorsy raises a $50,000,000 series C round from Altos Ventures, Autotech Ventures, Aviva, Aviva Ventures, and Tandem Capital.