Cannabis Industry Financial Consultants

OUR CLIENTS ENGAGE US WHEN THEY NEED HELP WITH...

Why Choose Us

There are three different segments cannabis investors that clients can reach with support from Lions Financial:

- Top-tier angel investor networks, VC funds, Private Equity funds.

- Mid-tier small angel investors

- Bottom-tier crowdfunding platforms reaching individual micro angel investors

01

Capital Raise

We help our clients with the the marketing and risk-mangement process for raising capital. We help clients put together their investment overview and pitch deck documents. While doing so, we keep in mind securities regulations,

the length of time the capital raise will take and coach our clients on what investors’ expectations are.

02

Valutions

For larger companies, the valuation may be more commonly thought of in terms of a multiple of EBITDA (earnings before interest, taxes, depreciation,

and amortization). For these companies, assuming modest growth of low to high single digits, a common fair valuation range is five

to seven times EBITDA.

03

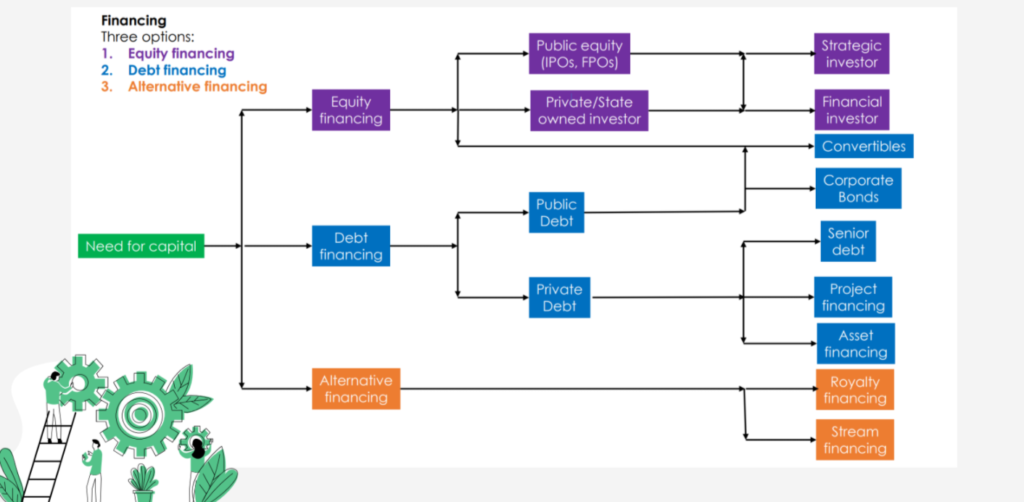

Alternative Financing

If a deal does not qualify for a traditional capital raise approach, we are able to offer clients alternative financing options through our network of Factoring Lenders, Peer-to-peer Lenders, Customer Lenders, Convertible Debt Lenders, Private Placement, And Corporate Bond

Investors, Venture Capital Lenders

Captial Raise Ladder

Business Financing Strategies

Loans

We Will Help You Every Step Of The Way

Lions Financial can help your executive team submit applications with multiple

financing institutions to best position your company for approval