Финансовые консультанты в индустрии каннабиса

НАШИ КЛИЕНТЫ ОБРАЩАЮТСЯ К НАМ, КОГДА ИМ НУЖНА ПОМОЩЬ В...

Почему выбирают нас

Существует три различных сегмента конопляных инвесторов, которые клиенты могут охватить при поддержке Lions Financial:

- Лучшие сети инвесторов-ангелов, венчурные фонды, фонды прямых инвестиций.

- Мелкие инвесторы-ангелы среднего уровня

- Краудфандинговые платформы нижнего уровня, достигающие индивидуальных инвесторов-микроангелов

01

Привлечение капитала

Мы помогаем нашим клиентам в процессе маркетинга и снижения рисков для привлечения капитала. Мы помогаем клиентам составлять инвестиционные обзоры и питч-деки. При этом мы не забываем о правилах обращения с ценными бумагами,

продолжительность привлечения капитала и обучить наших клиентов ожиданиям инвесторов.

02

Valutions

Для более крупных компаний оценка чаще всего выражается в кратном показателе EBITDA (прибыль до вычета процентов, налогов и амортизации),

и амортизации). Для таких компаний, предполагающих умеренный рост от низких до высоких однозначных цифр, общепринятый диапазон справедливой оценки составляет пять

до семикратного показателя EBITDA.

03

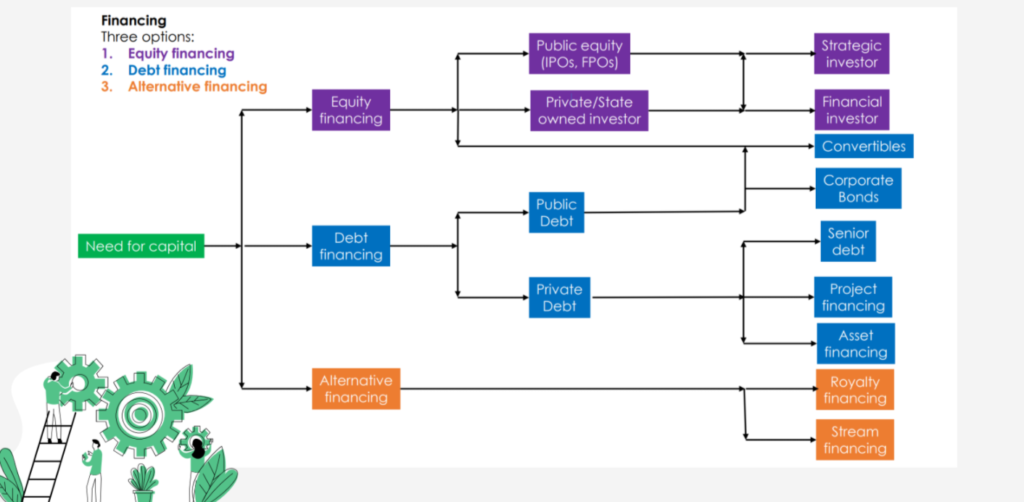

Альтернативное финансирование

Если сделка не подходит для традиционного подхода к привлечению капитала, мы можем предложить клиентам альтернативные варианты финансирования через нашу сеть факторинговых кредиторов, пиринговых кредиторов, кредиторов клиентов, кредиторов конвертируемого долга, частных размещений и корпоративных облигаций.

Инвесторы, кредиторы венчурного капитала

Лестница для капитального подъема

Стратегии финансирования бизнеса

Кредиты

Мы поможем вам на каждом этапе пути

Lions Financial может помочь вашей команде руководителей подать заявку на участие в конкурсе с несколькими

финансовые учреждения, чтобы наилучшим образом подготовить вашу компанию к одобрению