Company Overview

- Compagnie G érale Transaérienne was the first air transport company in France back in 1909

- The first passenger airlines appeared at the end of WW1. Private capital bankers mainly backed it in association with aircraft manufacturers.

- Pierre-Georges Latecoere launched Les Lignes Latécoère in 1918 to carry mail.

- Various other individual airlines were created for different purposes and destinations.

- Throughout 1923-1933 the airlines grew fivefold.

- When the financial crisis hit in the early 1930s, the airlines were brought together into one corporation and became Air France.

- Air France saw growth in flying colors but was interrupted by WW2

- After WW2, the privately owned Air France became a state-owned public company

- Beppo de Massimi, who was the founder of one of the individual airlines that makes up Air France, brought 5 separate airlines to back the newly formed air France while Didier Daurat served as the Director of Operations

- The founders are no longer actively invested in the company.

Founders & Board of Directors

ANNE MARIE COUDERC

- Graduated in private law and holds a French Professional Lawyer?s Certificate (Certificat d?aptitude à la Profession d?Avocat)

- Began her career in 1972 as a lawyer with the Paris Bar.

- Became Chief Legal Officer in Hachette?s industrial division between 1979 and 1982.

- Different management functions within the Lagardère Group from 1982 to 1995

BENJAMIN SMITH

- spent 20 years at Air Canada, where he held the positions of President of Airlines and Chief Operating Officer

- In 1990, he started part-time as a Customer Service Agent at Air Ontario.

- In 1992, he established his retail corporate travel agency, successfully running this business for eight years.

- In 1999, he also worked as a consultant for Air Canada before joining the airline in 2002.

- He became Vice President of Network Planning before joining the Air Canada executive management team in 2007 as Executive Vice President and Chief Commercial Officer

- 2014, became COO of Air Canada

- 2018, appointed CEO of Air France and a few months later joined the board of directors

ANNE RIGAIL (CEO)

- graduate of the Mines Paris Tech business school

- 1996, she was appointed head of Air France Customer Services at Paris-Orly

- 1999, she became head of Passenger and Baggage Connections at Paris-CDG.

- 2005, she was promoted to head of operations and

- 2009, became VP Paris-Charles de Gaulle hub.

- 2013, joined the Air France Executive Committee as EVP of in-flight services, in charge of the cabin crew.

- January 2017, Appointed EVP of Customer Experience

- December 2018, CEO of Air France

GAEL AMAUDRY (Director Staff Representative)

- Joined Air France in 1988 after 15 years in the cargo division, 10 years in IT, 5 years in HR

ALEXANDRE BOISSY (Air France-KLM permanent representative, Executive director)

- graduate of the Ecole Nationale des Ponts et Chaussées

- joined Air France in 1999, where he held the positions of consultant, manager, and Operations Research Manager

- Air France-KLM Operations Research Manager from 2014 to 2016. In 2016, he was appointed Chief of Staff to the Air France-KLM CEO and Secretary of the Group Executive Committee

- September 2018, he has been Deputy General Secretary and Chief of Staff to the Air France-KLM CEO, and SVP Communication, customer studies, and Group brand strategy

PIETER BOOTSMA

- graduate of the University of Twente and holds a Ph.D. in Business Engineering & Management Science

- 25+ years experience in the commercial airline industry

- In 2014, he was appointed EVP of Commercial Strategy Air France-KLM.

- Pieter Bootsma was a board member of the Airline Tariff Publishing Company (Washington, USA) from 2004 to 2009 and a member of the KLM Executive Committee from 2011 to 2013

- Since 2013, he has been Chairman of the Board of Directors for Transavia France and a member of the Air France-KLM Executive Committee.

VERONIQUE DAMON (Director Staff Representative)

- Management and Applied Economics graduate of Paris IX Dauphine University and a former National School of Civil Aviation (EPL) student. She holds an airline transport pilot license (ATPL)

FRANCESCA ESCERY (Independent director)

- Graduate of Geneva University in Political Science and International Relations holds an MBA from Harvard Business School.

- Independent director on the boards of F&C Investment Trust plc, Marshall Motor Holdings plc, and CT Automotive plc

- McKinsey & Co, Inc, Pepsico, Inc from 1991 to 1994, Thomas Cook Group (UK) in 1994 as Marketing Director of Thomas Cook Promotions, and then

- Marketing and Sales Director of Going Places Leisure Travel Ltd.

- From 2001 to 2007, she was Managing Director of STA Travel’s international division in London.

- Managing Director of Cheapflights Media UK in 2007

- Group Business Development Director from 2009 to 2011.

SILVIA GONZALES

- Master?s degree in social and economic administration with an option in private business administration

- She joined the Air France Group as a service agent in Montpellier in May 1999. She then became a leader before being appointed operations manager in 2021.

- After being a staff representative, elected works council member, employee advisor and negotiator of company agreements, and union trainer, she was deputy general secretary of the CFDT union in the Air France Group.

FABRICE HURET (Director Staff representative)

- Undergraduate technological diploma in marketing techniques and a degree in human resources

- They started as a flight attendant.

CATHERINE JUDE (Executive Director)

- Civil aviation engineer, a graduate of Ecole Polytechnique and the National Civil Aviation School, and holds a Master of Science in Transportation Engineering from the University of Berkeley in California

DJIBRIL KOITA

- Accounting and commerce, Djibril KOITA worked in several subsidiaries of the Air France Group (SERVAIR and ACNA) as a team manager in aircraft supplies.

- He is currently an instructor in aircraft movements and flight safety relays.

BRUNO METTLING (Independent Director)

- Graduate of the IEP political science institute of Paris and the Aix en Provence law school

- Founder and chairman of Topics, a consultancy firm in internal transformation strategy

- He began his career in the budget department of the Ministry of Finance, as well as many other ministries after

- 1995, Financial Controller and Deputy Vice President Finance for La Poste group

- Banque Fédérale des Banques Populaires where he was appointed Deputy CEO

- Chairman and Chief Executive Officer of Orange in Africa and the Middle East, later promoted to chairman

URSULA SAINT-LEGER

- A history graduate from the Sorbonne University in Paris

- Chief HR, Communications, and CR Officer at the Belgian company Aliaxis

- Senior Vice President Human Resources for the American company AptarGroup, member of the Executive Committee, and Chairwoman of the European head office

VINCENT SALLES (Director Staff Representative)

- Vocational training certificate (CAP) in auto mechanics

- Vocational training certificate in aeronautical structure mechanics

- Co-Secretary General of the Air France CGT union

BERNARD SPITZ

- Graduate of IEP Paris (political science institute), ESSEC business school and ENA

- Member of the Cabinet for Prime Minister Michel Rocard (Advisor) and Secretary of State for Planning Lionel Stoleru (Cabinet Director)

- Director of the Canal + group in charge of digital strategy and development

- Director of Strategy for Vivendi Universal

- President of the International and European Pole

FLORENCE VERZELEN

- Graduate of the Ecole Polytechnique (specializing in Economics and Finance) and the Ecole des Mines

- Executive Vice President Industry Solutions, Marketing, Global Affairs, and Communication Dassault Systemes

- VP for the Performance Plan

- Deputy Director of Engie Europe, in charge of Operations, Business Development, and Innovation, and Managing Director of Engie Russia

Executive Team

Product Positioning

- As things are returning to normal, Air France has launched a new program named ?New Horizon.?

- Working with Boston Consulting Group (BCG), Air France’s goal is to breakeven 2nd or 3rd term of 2022

- Also, working to reduce CO2 emissions. The goal is to reduce 30% emissions passengers/km by 2030

5 priorities to act upon to reduce CO2

- Fleet renewal in the aircraft A220, A320, and Airbus 350. These are the new generation aircraft that are fuel efficient, reduce CO2 emissions by 25%, and have 33% less noise footprint

- Incorporate more Sustainable Aviation Fuel (SAF) in flights. Currently, 1%, 10% by 2030, and 60% by 2050

- Eco-piloting techniques: AI is driven to find the most efficient route. Taxiing only uses one engine whenever possible. Continuous descent in working with air traffic control to reserve fuel

- Local produce is favored for food served in lounges and planes to reduce carbon footprints.

- Working with French national rail operators to provide low-carbon transport for short-distance journeys

The 4 pillars of CSR Strategies

- Environment: Reduce our environmental footprint by improving our operations, innovating in the supply chain, and mobilizing our staff and the industry

- Customer experience: Integrate sustainability within the entire value chain to offer our customers sustainable and innovative products and services

- Responsible human resources: Maintain a responsible social policy and encourage personal development to ensure the motivation and drive of our employees

- Local development: Create economic and social value, through our network, at hubs and destinations.

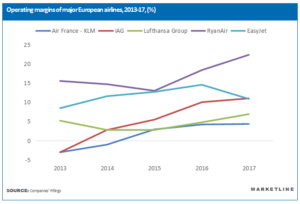

Competitive Analysis Globally

Competitors of Air France globally. They target the same classes and categories of customers in terms of price points (Air France Fleet size: 212)

Below are the top 3 airlines within each of the respective regions

Asia

- Singapore airlines (152)

- ANA (214)

- Japan Airlines (279)

Europe:

- Lufthansa (285)

- British Airways (253)

- KLM (bought by AF)

US

- Delta (877)

- Jetblue (285)

- Southwest (735)

Financial Statements Research

The presentation currency used in the Group?s financial statements is the euro, also Air France-KLM?s functional currency.

Balance Sheet:

- Big changes:

- Cash and cash equivalents: From 2019-2021, it?s 3.715 ? billion, 6.423 ? billion (increased around 72.89%), and 6.658 ? billion. It had a considerable increase in 2020, meaning a vast increase in liquidity.

- Issued capital: From 2019-2021, it?s 429 ? million, 429 ? million, and 643 ? million (an increase of around 214 ? million). On April 6, 2021, the European Commission decided to authorize the ?4 billion transaction by the French State to recapitalize Air France and Air France-KLM. The capital increase resulted in the issuance of 213,999,999 new shares (the ?New Shares?) at a price per share of ?4.84. The Company?s share capital increased to ?642,634,034 divided into 642,634,034 shares, each with a nominal value of ?1.

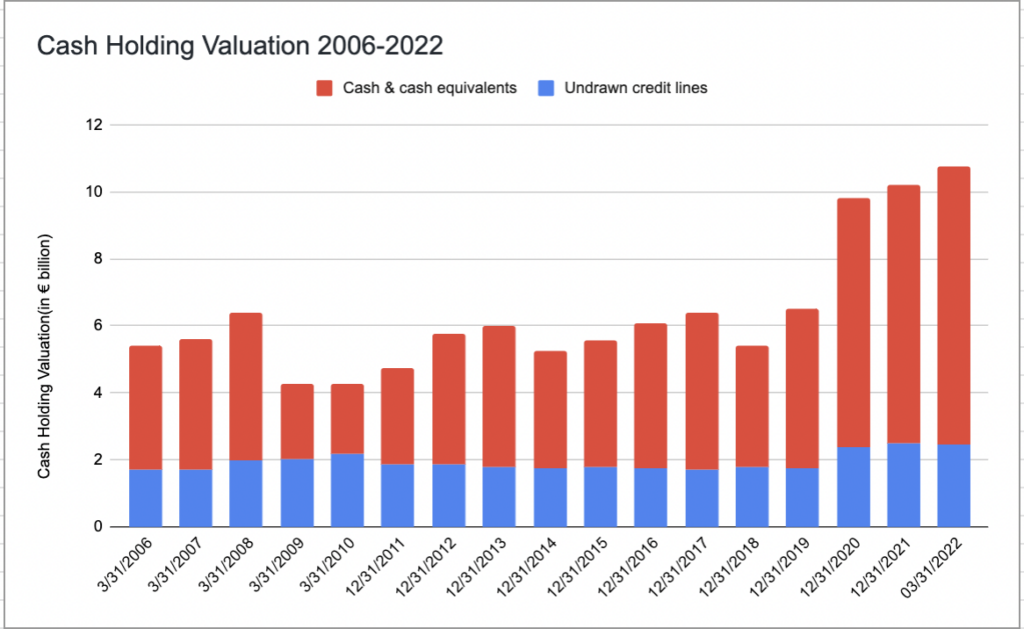

- Liquidity:

- Cash Holding Valuation 2006-2022

The IPO for Air France was launched in 2004. I collected data on cash holding valuation from 2006 to 2022. The total cash saving trend increased, representing increasing liquidity for Air France. In recent years, there was a decline in 2018 and a significant increase (around 50.77%) in 2020. The total cash holding for the first quarter of 2022 is 10.76 ? billion. It?s the highest cash holding value in recent years, which means high liquidity in 2022. It insulates firms from risk in the financial markets, ensuring the ability to fund critical projects and compete strategically in their product market.

-

- Current ratio

The current ratio from 2019-2021 is 0.68, 0.84, and 0.91. Although the percentages are all negative, the company?s debts due in a year or less are more significant than its assets. But the trend for Air France is positive, which could indicate better collections, faster inventory turnover, or that the company has been able to pay down debt.

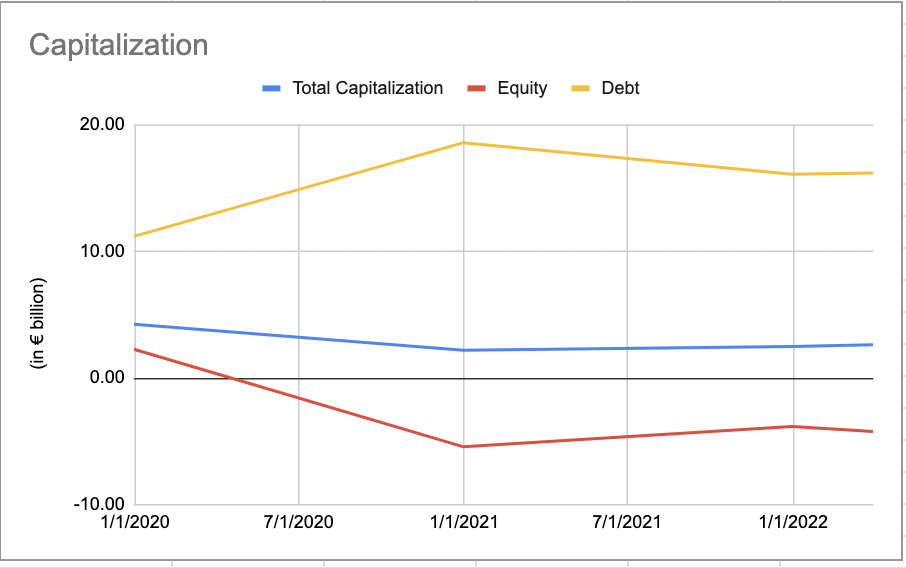

- Capitalization:

Source Investopedia

Air France’s total capitalization decreased from 2019 to 2020 (?4.25 billion-?2.19 billion), but it gradually increased after the beginning of 2021. On March 31st, the total capitalization was ?2.63 billion, the debt was ?16.2 billion, and the equity was ?-4.22 billion. Then, the D/E ratio from 2019 to 2022 is 4.91, -3.43, -4.21, and -3.84. After 2019, the D/E ratio changes from positive to negative because the company has negative shareholder equity. But negative shareholders’ equity is still a risk for investors because it means a company’s liabilities exceed its assets. Before 2020, the equity was positive, so I conclude it was probably affected by COVID-19. Recovery from COVID-19 began in the second half of 2021 and continues through 2022.

-

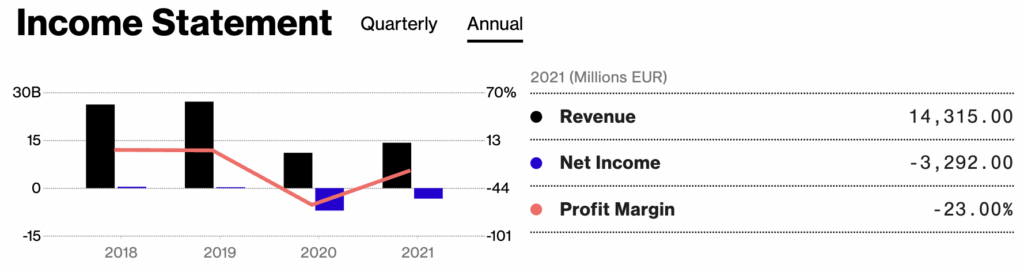

Income Statement:

- Big Changes:

- Revenue: From 2019-2021, it?s ?27.189 billion, ?11.088 billion (decreased about 59.22%), and ?14.315 billion.

- EBITDA (earnings before interest, taxes, depreciation, and amortization): From 2019-2021, it?s ?4.128 billion, ?-1.689 billion (decreased about 140.92%), and ?745 million.

- Net Income: From 2019-2021, it?s ?290 million, ?-7.078 billion (decreased about 2540.69%), and ?-3.292 billion.

The revenue, net income, and profit margin all significantly decreased from 2019-2020 but gradually increased after 2020. The profit margin in 2021 is negative 23%

Source macrotrends

- Earnings per share: From 2019-2021, it?s 0.64 euros, -16.56 euros(decreased about 2687.5%), and -5.95 euros. Negative EPS indicates the company is losing money or spending more than it is earning, and it?s a potential risk.

-

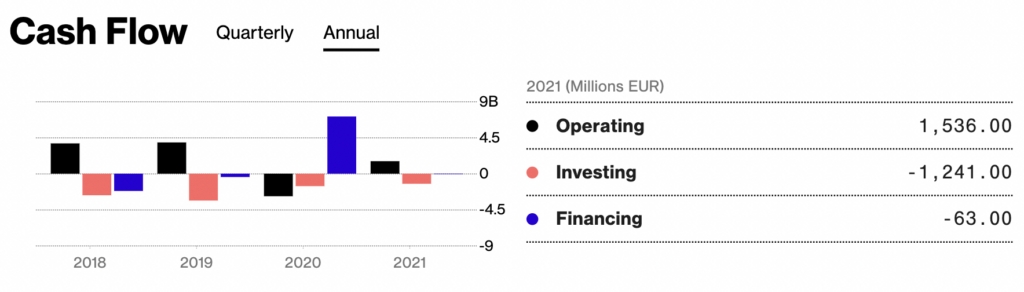

Cash Flow Statement:

- Big Changes:

- Net cash flow from operating activities: From 2019-2021, it?s ?3.895 billion, -?2.826 billion, and ?1.534 billion.

- Net cash flow used in investing activities: From 2019-2021, it?s -?3.318 billion, -?1.583 billion, and -?1.239 billion. The negative cash flow from investing might be caused by the company investing in its future growth because management is investing in long-term assets.

- Net cash flow from financing activities: From 2019-2021, it?s -?447 million, ?7.147 million, and -?77 million. It had a huge increase from 2019 to 2020 and a considerable decrease.

- Operating free cash flow: From 2019-2021, it?s ?623 million, -? 4.721 million, and ?231 million.

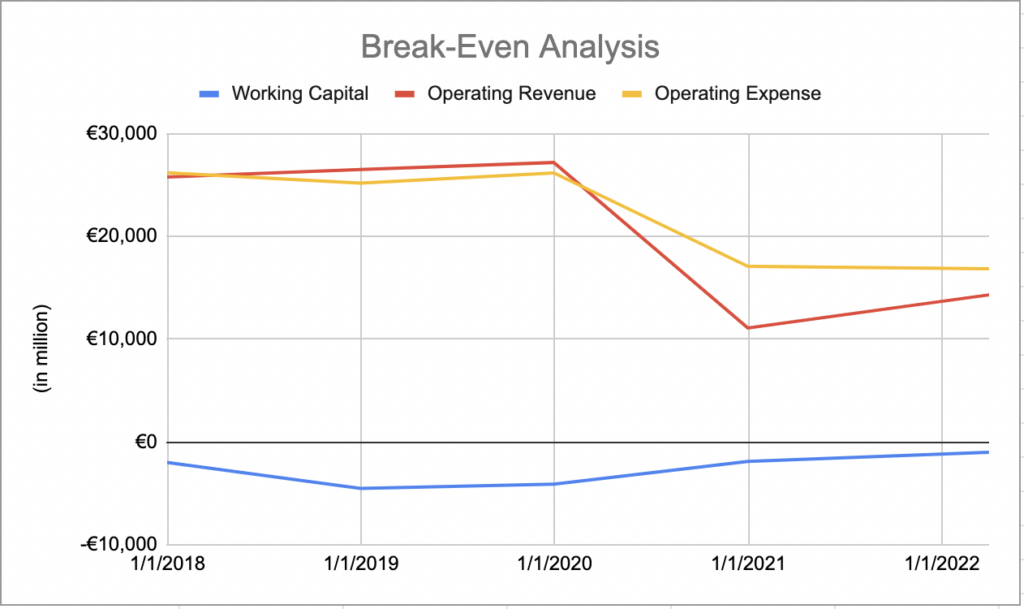

- Break-Even Analysis:

Source Investopedia

Regarding working capital, although there is an increase after 2019. It has been negative since 2018. Negative working capital represents a company’s current liabilities exceeding its existing assets, so negative working capital is one potential risk for Air France.

Then, about operating revenue and operating expense, we can see that before 2020, the revenue was higher than the expense. However, after the beginning of 2020, the expense is higher than the revenue, and both revenue and expense show a decreasing trend. On March 31st, 2022, the operating revenue was ?14.315, and the operating expense was ?16.847. Therefore, another potential risk for Air Franc is that the revenue cannot cover the expenses.

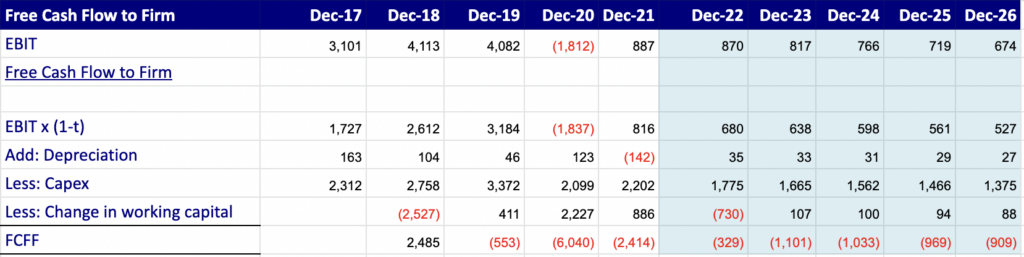

Discount Cash Flow Model Projections:

Source Investopedia

The discounted cash flow projection predicted the following five years based on the historical data of the past five years.

First, about revenue, the growth rate for the following year is the average of the past 5 years which is -6.2%, which leads to a decreasing revenue growth trend. Then, EBITDA, or earnings before interest, taxes, depreciation, amortization, and Earnings before interest and taxes, both show an increasing trend, but they are still negative.

Then, the free cash flow changed from positive to negative in 2019. The free cash flow would increase for the projection, but they are still negative. Negative free cash flow indicates an inability to generate enough cash to support the business, so it’s another potential risk for Air France.

Based on the cash flows, the NPV of the explicit period is – ?7.226 billion.

Last, the share price projection becomes harmful based on the perpetual growth (-10.9) or the exit multiple (-2.5). This will be different from the realistic stock price, and the Covid 19 in 2019 and 2020 also significantly impacted the result. Still, it is a potential risk for shareholders and investors, so they can be more cautious about investing or continuing to hold stocks.

-

Valuation Multiples Comparison:

- EV/Sales(LTM): A high EV/Sales ratio often means the company is overvalued. From the chart, we can conclude Air France is On average among competitors. Recently, it has shown an increasing pattern which is a bad sign, but overall, it decreased from the beginning of 2021.

- EV/EBITDA(LTM):

Source Investopedia

As a general guideline, analysts and investors commonly interpret an EV/EBITDA value below 10 as healthy and above average. As of Dec. 2021, the average EV/EBITDA for the S&P 500 was 17.12. In the first quarter of 2022, It?s 8.7x, which is a healthy value to the investors, and overall we can conclude that Air France has a relatively low EV/EBITDA.

- Price/Earnings:

Source Investopedia

- A lower P/E suggests investors believe earnings growth may slow going forward. We can see a decreasing trend after 2020, and the P/E ratio is 6.9x.

-

2022 First Quarter performance:

Compared with the first quarter of 2021, the EBITDA for the first quarter of 2022 changed from negative to positive. The Net income increased by about 62.8%. Also, The strong sales of the first quarter generated positive adjusted operating free cash flow, reducing Net Debt by ?550 million.

Target Market Research

- Target Customers for the Company:

a). Path and Destinations:

- Domestically, Air France?s network centers around core hubs at Paris-Charles de Gaulle (CDG) and Amsterdam-Schiphol (AMS). Core hubs have a solid local passenger share, high penetration of customers loyal to Air France, competitive cost position, and strong margins.

- Internationally, Air France has 175 international destinations in 93 countries (including Overseas departments and territories of France) across 6 continents.

Source airfranceklm.com

b). Ticket Price:

- Air France targets middle-class to upper-class passengers looking for a luxury/comfortable airline experience. At the same time, it also offers a basic cabin to attract customers from low-cost carriers, such as Joon and Air France Hop.

c). Frequent travelers:

- Air France introduced a loyalty program named Flying Blue to frequent travelers. Flying Blue now has 17 million members worldwide, who have access to many awards and benefits, and can earn and spend miles with a wide selection of airline, retail, and financial partners.

2. How do they acquire targeted customers?

Air France Marketing Strategy & Marketing Mix (4Ps: Product, Price, Place, Promotion)

a). Product Strategy:

- In terms of its inflight products & services in its marketing mix, it offers four kinds of services: Premiere, Business, Premium Economy & Economy.

- Air France has Le Salon lounges for its privileged fliers offering varied services. The inflight services provided by Air France are considered the best in class and high quality in terms of menu and entertainment. Apart from this, Air France provides on-ground services like parking, duty-free shopping, baggage handling, and services at customer desk for boarding and booking tickets.

b). Pricing Strategy:

- Air France offers pricing as economy, premium economy, business & premium.

- Air France has lower fares tickets than its competitors and offers better services accordingly.

c). Place Strategy:

- Air France has flight services to more than 160 destinations internationally and more than 30 destinations within France.

- With its SkyTeam alliance through joint ventures, new routes and codeshare agreements are being developed.

- Airline tickets for booking through Air France are available offline and online. There are direct bookings for Air France through counters or indirectly through travel agents and tour operators or the phone.

d). Promotion & Advertising Strategy:

- The company uses direct advertising of the brand through media like news, magazine, and television.

- Air France offers passengers some of the best deals in terms of pricing to different destinations as a part of its promotion.

- To retain passengers, the airline has the Flying Blue scheme, the frequent flyer program wherein points are given based on miles traveled.

-

What types of marketing does the company do to increase its brand recognition?

a). Advertising

Air France adopted a slogan in March 2014: ‘Air France, France is in the air.’ It portrays France as open and international, highlighting the positive universal values associated with the country: the art of living, the unique French spirit, luxury brands, and Michelin-starred chefs with a following both in France and abroad.

On 8 March 2015, continuing from the campaign launched in March 2014, Air France launched its new advertising film ‘France is in the Air’ in France and five other countries (the United States, Brazil, Japan, China, and Italy). This advertising spot was broadcast on television channels, in cinemas, via digital channels, and on social networks. It expressed the airline’s openness to the world and its pride in offering a one-of-a-kind journey à la française ? with elegance, inventiveness, and humor. It features the very best of France: a France that is positive, welcoming, and inspiring, a shining light across the entire world. A few weeks after its launch, the new Air France advertising film had been seen over 8 million times on YouTube.

b). Marketing Alliances with Other Airlines

- SkyTeam

As a member of the SkyTeam global airline alliance, Air France links its network with the route networks of the other member airlines, providing opportunities to increase connecting traffic while offering enhanced customer service through reciprocal code sharing and loyalty program participation, airport lounge access, and cargo operations.

- Joint Venture

Air France, KLM, Delta, and Virgin Atlantic are in a joint venture partnership. This partnership provides customers with more convenient flight schedules and a shared goal of ensuring a smooth and consistent travel experience, whichever airline people fly. The partnership also allows booking flights on any of the four carriers through their respective mobile apps, websites, or travel agents. Customers will enjoy award-winning service, top-tier premium cabin products, and complimentary food, drink, and seat-back in-flight entertainment on all trans-Atlantic flights.

Enhanced customer benefits starting from 13 February mean that loyalty program members will be able to earn and use miles or enjoy elite benefits for flights on any of the four airlines? worldwide operations, including a trans-Atlantic trip, intra-Europe hops, or domestic U.S. journey, offering more opportunities to move through loyalty tiers and reach a higher status quickly. Eligible Elite loyalty program members can enjoy priority boarding and relax in over 100 airport lounges when traveling internationally.

c). Environmental Sustainability

In 2019, to reduce its environmental footprint, Air France has set itself the objective of replacing 80% of single-use plastics with sustainable alternatives by 2025 while complying with the regulatory and health constraints imposed on airlines. Their new mission is to produce 30% fewer emissions per passenger/km in 2030 than in 2019.

Source airfranceklm.com

The Air France-KLM Group reduced its noise footprint by nearly 40% during the 2000s, whereas the number of aircraft movements increased by 18% over the period (excluding the Covid years).

d). Community Engagement

Air France works to help disadvantaged children through its Corporate Foundation. Since its establishment in 1992, the Foundation has facilitated the realization of 1,520 projects for children in difficulty and sick children, sponsored mainly by Air France employees. In 2019, the Foundation supported 63 projects across 32 countries to benefit 155,000 children.

In 2020, the Air France Foundation adapted its projects while pursuing its primary objective: supporting children. The Foundation finances educational projects contributing to fostering new kinds of behavior and increased understanding of climate issues, together with training and awareness?raising projects on sustainable practices respecting natural resources. The long?standing projects on education for sick, disabled, and vulnerable children are being pursued and now include environmental issues.

In this particularly challenging year, the Air France Foundation also supported six projects directly linked to the social and health crisis while offering Air France employees the opportunity to get involved. In 2020, the Air France Foundation was active in 36 projects and 18 countries with 110,000 beneficiaries. The Friends of the Air France Foundation network mobilizes more than 4,800 employees around volunteer work, skills?sharing, and donation?based initiatives.

Brand Positioning

The unique in-flight travel experience and a caring attitude at every step of the journey that Air France KLM provided have effectively distinguished it from the rest of the airline companies in Europe.

-

Service and Equipment Quality:

- Air France is Certified as a 4-Star Airline for the quality of its airport and onboard product and staff service. Product rating includes seats, amenities, food & beverages, IFE, cleanliness, etc., and service rating is for both cabin staff and ground staff.

Source Apex

- On 8 June 2022, at the 2022 APEX Passenger Choice Awards ceremony, Air France won the “Best Entertainment in Europe” award. This award recognizes the quality and diversity of the entertainment offered on board its long-haul flights.

- On 22 October 2021, at the 28th World Travel Awards ceremony in London, Air France was awarded the prize for best European airline for its business class cabin.

- At TheDesignAir Awards, Air France won the prize for the best new airport lounge 2021 for its lounge in terminal 2F at Paris-Charles de Gaulle airport, created in collaboration with the design agency Jouin Manku.

-

Customer Satisfaction:

- On 8 March 2022, Air France was awarded first prize at the Customer Relations Awards® in the Transport category for the 7th year running. Organized by BearingPoint and Kantar, this ranking truly reflects the voice of French customers.

- Based on the survey conducted by BearingPoint and Kantar:

a). 93% of customers intend to choose Air France for a future trip, more than 8 points higher than the average score in the Transport category and 6 points higher than the average score for all sectors combined.

b). 88% of customers consider Air France exemplary in how staff serves customers, more than 14 points higher than the average score in the Transport category and 7 points higher than the average score for all sectors combined.

c). 89% of customers consider that staff takes pleasure in serving customers, more than 13 points higher than the average score in the Transport category and 8 points higher than the average score for all sectors combined.

SWOT Analysis

Strengths

- Brand value and recognition & Customer Loyalty

a). Air France- KLM owns well-established brands — KLM and Air France

- KLM started in 1919 and is the world’s oldest airline still operating.

- Air France was established in 1933 and is 88 years old now.

b). Air France-KLM’s CDG and AMS hubs are among Europe’s top five airports.

c). Loyalty program — Flying Blue

- Designed for premium members and frequent travelers

- Growing membership

iii. Using miles to buy reward tickets, upgrade seats, or spend them on non-airline businesses

- Strategic alliances through joint ventures

a). SkyTeam Alliance

b). Joint ventures with Delta and Virgin Atlantic

Improve access to markets internationally and domestically; improve joint sales and marketing coordination, co-location of airport facilities, and other commercial cooperation arrangements.

- Serving different market segments

a). Air France provides three main areas of services: passenger transport, cargo transport, and aircraft maintenance.

b). The full-cost carriers offer First Class, Business Class, Premium Economy & Economy.

c). Air France-KLM has subsidiary airline companies which function in the low-cost segments in the European markets, namely HOP, Transavia and JOON airlines.

- Solid financial foundations

Air France-KLM generated 14 billion euros worth of revenue in 2021. The vast majority of the revenue came from passenger transport services. The airline carried 44.7 million passengers in 2021. Compared to 2020, Air France-KLM raised around 3 billion euros in total revenue.

- Superior customer experience

On 8 March 2022, Air France was awarded first prize at the Customer Relations Awards® in the Transport category for the 7th year running. Organized by BearingPoint and Kantar, this ranking truly reflects the voice of French customers.

Weaknesses

- Low-cost airline branding

There is evidence of poor branding strategy for the low-cost airlines of Air France-KLM. Transavia, HOP!, and JOON are new companies and are not well recognized by the customer base.

- Dependence on the domestic market

While the domestic market is rapidly recovering to the pre-pandemic level, international demand continues to lag. This could hinder the global expansion of Air France.

3, High cost of replacing existing experts

Few employees are responsible for Air France KLM’s knowledge base; replacing them will be extremely difficult in the present conditions.

Opportunities

- Joint Venture

The joint venture is worth exploring for Air France. Air France could expand its domestic and international routes (Asia) and meet more demands.

- Changes in consumer behavior post Covid-19

Consumer behavior has changed in the Airline industry because of Covid-19 restrictions. Some of this behavior will stay once things get back to normal. Air France KLM can take advantage of consumer behavior changes to build a more efficient business model.

Threats

- Strong Competition

The airline is facing intense competition from LCC airlines and the decreasing customer preferences to travel by train and other forms of transport such as carpooling.

Air France also faces the problem of increasing new competitors. In 2020 alone, more than 1.5 million new business applications will be in the United States. This can lead to greater competition for Air France KLM in the Airline sector and impact the organization’s bottom line.

As technology is more democratized, the barriers to entry to the Airline industry are lowering. It can present Air France KLM with more significant competitive threats in the near to medium future. Secondly, it will also put downward pressure on pricing throughout the Airline sector.

- Distrust of institutions and the increasing threat of legal actions

As the WTO regulations and laws are difficult to enforce in various markets. Legal procedures have become an expensive and long-drawn process. It can lead to less investment into emerging markets by Air France KLM, thus resulting in slower growth.

Mergers and Acquisitions

| Date of Acquisition | Companies acquired | Importance |

| 2004-05-05 | KLM Royal Dutch Airlines |

|

| 2009-01-12 | Alitalia |

|

| 2014-03-31 | Barfield, Inc |

|